Marriage is a big event in life; two people come together and promise each other to spend their lives together and combine everything. While these people come together, there are some unpleasant topics that should also be discussed in order to make sure both partners have a secure future.

That brings us to the question, “What’s an Estate in Marriage?” It explains how marital property and inheritance laws work. We are here to explain everything about an estate in marriage, from how it works to what the inheritance rules should be.

What’s an Estate in Marriage?

An estate in marriage refers to all the assets owned individually or jointly by the couple. These include assets such as real estate properties, vehicles, personal properties, bank accounts, or retirement funds. In a marriage estate, the two categories of focus should be the main concern. They are:

- Marital Property: Marital properties include all the assets that the couple acquires together after the marriage. It doesn’t matter who paid for the assets. They are considered joint assets.

- Separate Property: These are properties that the partner has acquired individually, mostly before the marriage. However, some of these assets can be converted into joint assets after the marriage.

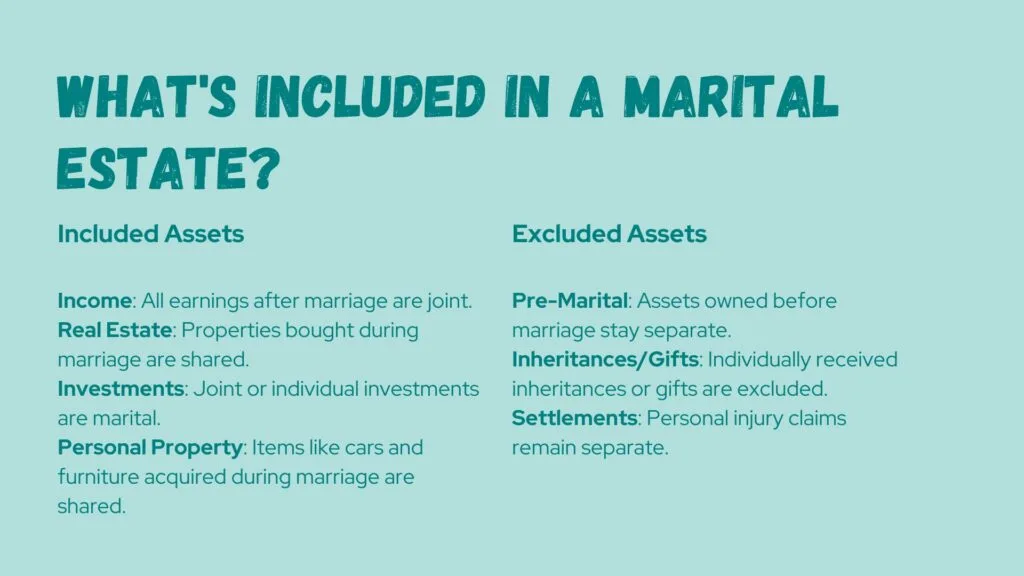

What’s Included in a Marital Estate?

Included Assets:

- Income Earned During Marriage: All the income that the couple earns after the marriage is considered altogether in a marital estate.

- Real Estate: Every real estate property purchased after the marriage, whoever pays, is considered a joint asset.

- Investments: All the investments that the couple makes together or individually, whether it’s in jewelry, stocks, mutual funds, or retirement accounts, will be considered joint assets in the marital estate.

- Personal Property: Personal properties include cars, furniture, PCs, and all the other tangible assets that are acquired during the marriage.

Excluded Assets:

- Pre-Marital Assets: These are the assets that each spouse buys before the marriage. These assets are not to be included in the marital estate because they were brought for personal use, and the spouse was not legally married.

- Inheritances and Gifts: All the gifts and inheritance that each spouse gets from whatever source will be considered as their own and not private while considering marital estate.

- Legal Settlements: If any of the partners have personal injury claims or lawsuits, they are also excluded.

How is Marital Property Divided?

When a marriage ends, either by divorce or because of the death of a partner, the division of the estate is a complicated process. First of all, the division of marital estate depends on the state in which you live. In general, there are two types of systems for this: community property or equitable distribution.

Community Property States

In community property states (like California or Texas), assets are divided equally between the spouses, regardless of who bought them. This method only considers the assets bought during the marriage to be divided amongst the spouses.

Equitable Distribution States

The assets are divided fairly into states following equitable distribution (like New York or Florida). The court considers factors like the length of marriage, how much each spouse makes, and how much each spouse will need after the separation. After carefully considering these aspects, the court ensures the assets are divided fairly.

Inheritance and Marital Property

One of the most confusing things people are concerned about is whether inherited properties are considered joint assets.

So, the answer is no. They are not considered joint assets; inheritance, by very nature, is only addressed to one spouse, so the marital estate does not consider the inheritance received as a joint asset.However, it can change if the spouse decides to use the inheritance for joint purposes or shares it with their spouse by transferring the amount to a joint account or purchasing an asset with it under both names.

Protecting Your Inheritance

To protect an estate, you can take proactive steps:

- Keep it Separate: If you wish to keep your inheritance separate from the joint assets, don’t use it to buy joint assets; keep the amount separate.

- Use Prenuptial or Post-nuptial Agreements: Another way to keep your inheritance money safe is to sign a Prenuptial or Post-nuptial Agreement. These agreements ensure that you protect your inheritance and other assets in the event of a divorce.

- Consult a Legal Professional: You can consult an attorney or financial experts who can help you create a clause that clearly defines the inherited amount as your personal asset.

Do Spouses Automatically Inherit Everything?

The rules regarding inheritance vary in every state. For example, suppose a person dies without establishing a will; the first $50,000 will be inherited by the spouse, the remaining 50% of the assets will be transferred to the spouse, and the remaining 50% will be transferred to the deceased’s children or heirs.

READ MORE What is Estate at Will?

Frequently Asked Questions (FAQs)

Can my wife take half of my inheritance?

No, if the inheritance is received in your name, your spouse has no legal right to take the half. Unless the inheritance also includes your partner’s name, the inheritance will remain your legal asset.

How does inheritance work when married?

Inheritance is considered a personal asset, which means the asset is legally entitled in the name of the spouse who received it. The spouse can share their inheritance if they want by putting it into a joint account or purchasing assets together in their partner’s name.

How do I protect my inheritance from my spouse?

You can keep the inherited amount in your personal account, don’t use it for joint purchases, and add a clause in your post-nuptial agreement to ensure it stays with you.

Does a spouse automatically inherit everything in NYS?

No, the spouse inherits the first $50,000 and 50% of the shared assets.

Final Statement

Looking into marital estate may seem like a bad thing, something you might feel guilty about, but the fact is, you have to. Not just for your sake but even for the members you have in your family.

Times have changed. It is not like traditional ways where the parents set up their kids, and then everything must go on no matter what; even the slightest things can change your life around you, and sometimes, you don’t have a choice. So make sure you study what’s and estate in marriage to ensure that you have a financially secure future.