Mergers and Acquisitions are excellent for businesses looking to expand, diversify, or gain the upper hand against the competition. However, they are not all good news. When a business opts to acquire an existing or new company, both firms must undergo a great deal of complexity. This includes legal issues such as compliance, disputes involving the rights to intellectual property, employment contracts, and tax obligations.

That is where businesses need the Mergers and Acquisitions Law. The law ensures that the M&A deal goes smoothly by assisting the involved companies in handling complicated processes like regulatory approvals and risk mitigation strategies. With the government now involved, the business stakeholders expect the highest level of transparency in the firm’s activity, which makes the Mergers and Acquisitions Law one of the core components of an M&A.

In this article, we will go over the concept of Mergers and Acquisitions law. We will also explore its legal framework and demonstrate the value of legal advisers for an easier M&A transaction.

READ MORE What is a CPA Firm? Everything You Need to Know

What is Mergers and Acquisitions Law?

A Mergers and Acquisitions law refers to a legal structure that dictates the process when a company merges with another firm (Merger) or purchases another company (Acquisition). The M&A law ensures that everything during the process is in accordance with national, local, and international laws. Everything in the deal should comply with specific legal requirements to protect all the parties involved in the deal.

Key Components of Mergers and Acquisitions Law

Regulatory Compliance

Firms involved in M&A must acquire proper legal documents stating that their business is approved by various regulatory bodies. For example, in the U.S., the Federal Trade Commission (FTC) or the Department of Justice (DOJ) is responsible for reviewing large deals to ensure that this deal won’t lead to a monopoly in the market.

Due Diligence

Due diligence is the process of researching the new partner’s company before signing to ensure that it has everything in place and will not cause problems. This includes researching its finances, contract details, and any pending legal issues or other liabilities that can pull the company down.

Contracts and Agreements

Contracts and agreements are the key components of any Mergers and Acquisitions law. Both firms have to ensure that they include and read the terms of the contract to ensure that they agree to all the clauses included. These include clauses about purchase agreements, confidentiality agreements, non-compete clauses, and employment contracts.

Tax Considerations

Two firms merging can involve a great deal of taxation planning because the taxes from both firms are combined into one. The way in which a deal is structured, whether as a merger, asset purchase, or stock purchase, can significantly affect the tax burden of both the seller and buyer.

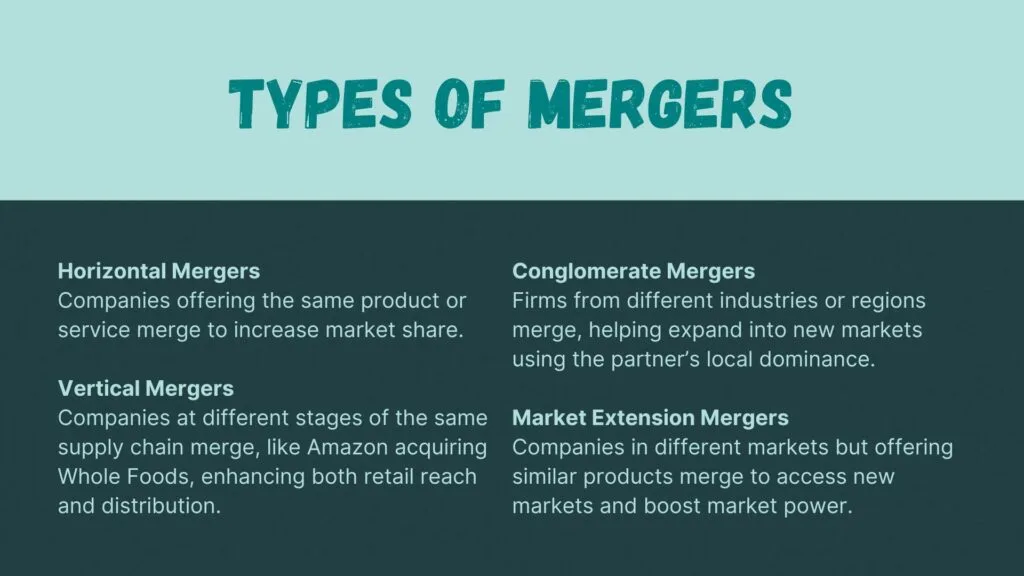

Types of Mergers and Legal Implications

- Horizontal Mergers: A horizontal merger occurs when two or more companies that make the same kind of product or service unite to create a large company. These mergers are a great method of increasing market share.

- Vertical Mergers: A vertical merger occurs when two companies operating at different levels of the same supply chain join forces. For example, Amazon purchased Whole Foods, a grocery chain. This was a vertical merger because it merged two companies operating at different points of the supply chain: Amazon in logistics and e-commerce and Whole Foods in retail grocery. The merger enabled Amazon to grow its reach in the physical retail market and improve its grocery distribution capabilities.

- Conglomerate Mergers: In a conglomerate merger, two or more firms from different industries and locations, such as different cities or countries, come together to establish a single holding company. Such mergers help companies enter new locations with the help of an already established company in that region with a solid and dominant market share.

- Market Extension Mergers: A market extension merger takes place between firms with different markets, but they induce the same type of product services. The aim of this merger is to tap into each other’s market and create a monopolistic scene in the current market.

Common Legal Risks in M&A Deals

- Antitrust Issues: Government bodies ensure that firms that decide to go through M&A don’t end up creating a monopoly in their industry. If this happens, the newly joined firms can be fined heavily, or the merger will be blocked by the regulatory bodies.

- Intellectual Property (IP) Disputes: These issues usually arise when two or more tech firms merge. When merging, it is important to handle the transfer of IP, such as patents, trademarks, software, or trademarks. If these things are handled carelessly, wrongful IP use, fraudulent activities, or infringement penalties can occur.

- Employee and Labor Law Issues: During M&A, many employees are laid off, as merging two firms means many employees of similar fields are coming together. This means the company has to select a few to retain and lay others off. However, many of the employees have a year-long contract with the company, which means laying them off could create a lot of legal issues pertaining to labor laws and union agreements.

- Data Privacy and Cybersecurity: Two companies coming together need a lot of transparency. Sometimes, this means sharing trade secrets. To ensure that both businesses keep their confidential data private, they must abide by privacy laws, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA).

- Cross-Border Deals: When businesses from different countries join, it can cause many issues due to the various rules and laws. These include risks like differing taxes or currencies, legal and political regulations, and operational dissimilarities.

The Role of Legal Advisors in M&A

There is a reason that businesses involved in M&A laws opt for M&A firms and legal advisors: They have experience and know everything about how the process is to go, what factors could complicate things, what issues can come up, and, more importantly, how to resolve these issues that the business cannot even comprehend or imagine handling.

The professionals not only handle the process but also help firms from the start. This includes helping them draft the contract with all the necessary details, reviewing others’ contracts, negotiating, dealing with regulatory filings, and providing advice on risk management.

If the transaction is very complicated and involves many factors because of the size of the merger, they also handle the tax implications by collaborating with financial experts and devising a strategy to tackle these situations. Moreover, they also help the business with any and all issues that happen during negotiations or after the merger.

READ MORE M&A Analyst – Career Profile

Frequently Asked Questions (FAQs)

What is the law of mergers and acquisitions?

The Mergers and Acquisitions law provides a legal structure that acts as a guideline for companies joining forces in a merger or transferring ownership to another business (acquisition). It ensures compliance with regulations to protect stakeholders’ interests and avoids monopolistic situations in the market.

Is M&A law difficult?

Yes, the Mergers and Acquisitions law can be complicated due to the need for specific agreements, approvals from regulatory authorities, and compliance with various laws, including tax, antitrust, intellectual property, and labor regulations.

What are the regulations for mergers and acquisitions?

Merger and Acquisition laws dictate that the deal must follow antitrust laws to avoid monopolies, securities regulations for public disclosures, labor laws, and proper tax implications. To ensure that every M&A deal follows these laws, we have regulators like the FTC or European Commission to oversee such transactions.

What does M&A law involve?

Mergers and Acquisitions law requires contract drafting and negotiation, conducting due diligence, obtaining regulatory approvals, managing risks, and ensuring that the law complies.

Final Statement

M&A is a complex concept, but the Mergers and Acquisitions laws provide detailed guidelines for firms and M&A professionals. The laws guarantee that the agreement protects the interests of its parties, such as the firm, the shareholders, and employees.

Companies can also hire lawyers and other legal professionals to act as representatives in an M&A deal for a safe and seamless transaction. The legal professionals are highly trained and have a wealth of experience. They have a highly experienced team that assists them in drafting an appropriate contract, managing the negotiation process, conducting due diligence, getting approval from regulatory authorities, controlling risks, and ensuring that the contract is in compliance with the required laws.

If you’re a business owner considering merging or a person with an interest in an organization that is considering a merger, being aware of the legal consequences of these transactions will assist you in making the right choices and make you better prepared if issues are raised.