A credit reference is an essential part of the finance and business world. It plays a huge role in lending and borrowing capital. Understanding what is credit reference, how it works, and its impact can help individuals and businesses manage their finances more effectively.

In this article, we will study what is credit reference, its importance, its types, and how it works.

What is Credit Reference?

A credit reference is a record provided by third parties, such as financial institutions or credit bureaus, that provides details about an individual or business’s creditworthiness. Loan lenders, landlords, and other entities use credit reference records to evaluate borrowers’ financial positions before providing capital or entering into financial agreements with them.

A credit reference provides a comprehensive document that includes details about the borrower’s past loans, repayment ability, outstanding debts, and current financial position. This document helps the investor or lender understand how well the applicant can manage credit responsibly and fulfil financial commitments.

ALSO READ ABOUT 8 Effective Strategies to Improve Your Financial Health

Importance of Credit References

Now that we’ve delved into what is credit reference, let’s explore why it’s so important to learn and understand this financial concept. By doing so, you can actively engage in handling your financial health and making educated decisions.

1. Risk Assessment

When we talk about what is credit reference, a credit reference is a valuable record for lenders and creditors that helps them evaluate the borrower’s financial position. It allows them to assess the borrower’s past payment record, debts, and financial situation.

A positive credit score indicates that the borrower has a good record of payments and indicates lower risk. On the other hand, a negative credit score indicates poor past repayment performance and a higher risk factor.

2. Decision Making Factor

A credit reference provides a snapshot of the applicant’s financial performance and position to lenders, creditors, and other financial entities. By revising these records, lenders can decide whether to approve the loan.

3. Financial Responsibility

An individual or business with a good credit score indicates that they have proved to be financially responsible in the past. Being financially responsible means that they have managed their finances effectively and meet all their financial commitments.

4. Negotiating Power

A good credit score can significantly tilt the negotiation in your favor when applying for credit. It’s a testament to your financial worthiness, and it’s your turn to demand favorable terms, interest rates, and credit agreements. This shift of power can give you the confidence to ensure the best possible deal.

Types of Credit Reference

Once you have cleared the basics and understood what is credit reference, It is crucial to be aware of the 5 categories of credit references.

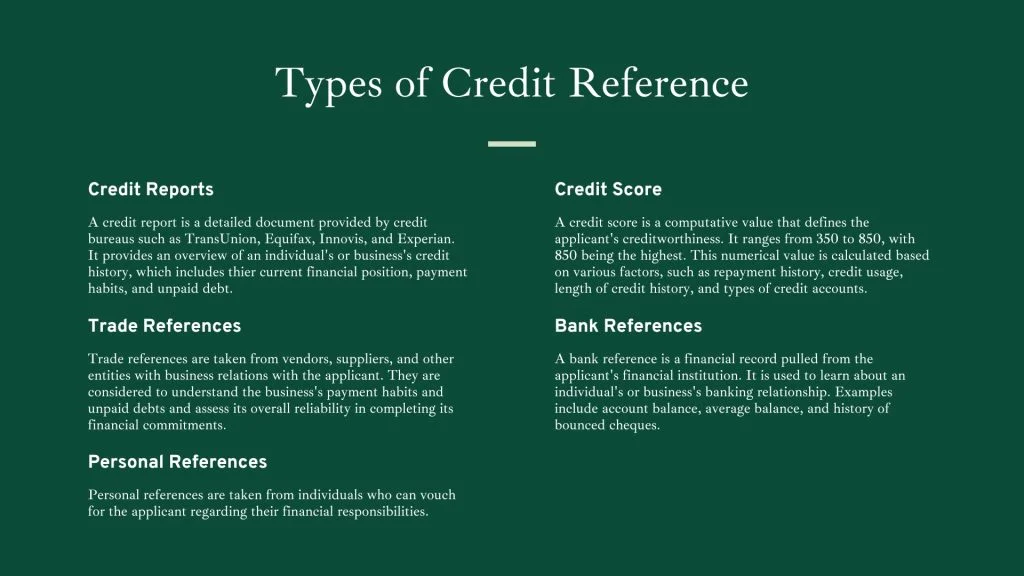

1. Credit Reports

A credit report is a detailed document provided by credit bureaus such as TransUnion, Equifax, Innovis, and Experian. It provides an overview of an individual’s or business’s credit history, which includes their current financial position, payment habits, and unpaid debt.

2. Credit Score

A credit score is a computative value that defines the applicant’s creditworthiness. It ranges from 350 to 850, with 850 being the highest. This numerical value is calculated based on various factors, such as repayment history, credit usage, length of credit history, and types of credit accounts.

3. Trade References

Trade references are taken from vendors, suppliers, and other entities with business relations with the applicant. They are considered to understand the business’s payment habits and unpaid debts and assess its overall reliability in completing its financial commitments.

4. Bank References

A bank reference is a financial record pulled from the applicant’s financial institution. It is used to learn about an individual’s or business’s banking relationship. Examples include account balance, average balance, and history of bounced cheques.

5. Personal References

When we talk about what is credit reference, a personal reference differs from others. Personal references are taken from individuals who can vouch for the applicant regarding their financial responsibilities. Although personal preferences may be unreliable, they provide helpful insights about the candidate.

Implications of Credit References

Here are some real-life implications to explain what is credit reference and how it is used.

What is Credit Reference For individuals?

- Loan Approval: A strong credit score ensures the loan application is approved.

- Interest Rates: People with strong credit scores are considered more reliable payment sources. Hence, they can secure lower interest rate payments.

- Credit Limits: Individuals with higher credit scores get more credit limits for loans and a higher credit card spending limit.

- Employment Opportunities: Sometimes, employers prefer to check candidates’ credit references while hiring for financial jobs.

- Housing Applications: Property owners use credit references to assess the applicant’s financial stability.

What is Credit Reference For Businesses?

- Supplier Relationships: Suppliers are happy to do business with someone with an excellent, timely payment history. It also enhances the opportunity to negotiate better credit terms.

- Financing Options: A good credit score increases the firm’s ability to secure a business loan or investment capital.

- Business Partnerships: While partnering up with other businesses, it is crucial ot check their credit reference to establish their financial stability and potential longevity.

- Reputation: Any business with a strong credit reference has a respectable reputation in the market.

Maintaining Positive Credit References

When you know what is credit reference, you understand how important it is to maintain a positive credit reference for your financial freedom. To maintain a solid and positive credit reference, you just have to follow these practices responsibly:

1. Timely Payment

The most crucial part of credit history is timely payment. Ensure that all expenses, including credit card payments, loans, and other utility payments, are paid on or before time. A timely payment guarantees a better credit score, while late payments negatively impact your credit history.

2. Debt Management

Make sure that each of your debts is manageable. Manage high-interest debts, including credit card payments, at first and keep them in check. Limit your credit card usage and pay the entire balance monthly; if not, do not let such high-interest payments pile up.

3. Monitor Credit Report

Check your credit reports regularly for accuracy and manage any disparities promptly. This will help maintain a positive credit history.

4. Diversify Credit

Maintaining a diversified range of credit accounts reflects that you can manage many credits simultaneously, increasing your credibility.

5. Limit Credit Inquiries

Extreme credit queries can reduce your credit score. Ensure you only do it when in need.

6. Build Long-Term Relationships

Build trusting relationships with creditors and suppliers to enhance your reputation. This will help you in the long run and in emergencies.

ALSO READ ABOUT 8 Important Steps for Personal Finance for Beginners

FAQs

What is credit reference example?

A credit reference example could be a credit report from a central credit bureau like Experian detailing an individual’s credit history, including accounts, balances, and payment timeliness.

Another example of a credit reference is a trade reference provided by a supplier. This reference confirms a business’s reliable payment history and adherence to credit terms, which can help the business establish trust with new suppliers or secure better payment terms.

How do I get a credit reference?

Request a credit report from a central credit bureau like Experian, Equifax, or TransUnion to get a credit reference. Additionally, you can ask your bank, previous creditors, or trade partners to provide a reference attesting to your creditworthiness and payment history.

Is a bank account a credit reference?

A bank account itself is not typically considered a credit reference, but a bank reference can be. A bank reference includes information about your account history, balances, and financial behavior, which can be used to assess your creditworthiness.

What is Credit Reference?

A credit reference is a record delivered by third parties, such as financial institutions or credit bureaus, that details an individual or business’s creditworthiness. Loan lenders, landlords, and other entities use credit reference records to evaluate borrowers’ financial positions before providing capital or entering into financial agreements with them.

Final Statement

Credit references play a huge part in the financial industry, providing valuable insights into an individual’s or business’s creditworthiness. Credit references are key to financial success, whether applying for a loan, securing a lease, or establishing business relationships.

By understanding what is credit reference, the importance of credit references, and adopting responsible financial practices, individuals and businesses can maintain positive credit histories, secure better financial opportunities, and build strong reputations.

I trust that this ‘What is credit reference?’ article has been helpful and informative. If you still have any questions or need further clarification, please don’t hesitate to use the comment box.