When someone establishes a trust, there are two main roles that jump up: A trustor and a trustee. A trustor is the one who establishes the trust and decides how everything is to be managed. A trustee on the other hand is like a manager, this person or entity is responsible for carrying out the plans and wishes of the trustor.

Both roles are important components of a trust, but they work in a different manner and have different responsibilities towards the trust. In this post, we will explore the difference between a trustee vs trustor, and reflect on how both these roles differ. For people who want to go through the basics, let’s start with what is trust, but if you are aware of it, you can jump directly to the trustee vs trustor with the help of the table of contents.

READ MORE The Biggest Mistake Parents Make When Setting Up a Trust Fund

What is a Trust?

A trust is a legal arrangement where the trustor transfers their assets, such as properties, financial accounts, or digital assets) to a trust. Once transferred, these assets are managed according to the rules that the trustor has in mind and written in their will.

A trust offers more flexibility and control over how the assets are to be managed rather than a traditional will transfer. In will transfer, once the assets are passed, the responsibility of the trust is finished, they can use the asset however they want. But here, the trust is also given a set of roles and responsibilities and a guideline on how to use the assets.

Who Is a Trustor?

A trustor is the one who establishes the trust. It can be an individual, a partner, or even an organization. The primary role of the trustor is to establish the trust, provide the names of the beneficiaries who will receive their assets, and name a trustee who will manage the said assets as per the trustor’s will.

Key Responsibilities:

- Establishing the Trust: The first and foremost responsibility of the trustor to to establish the will, or trust, and define its purpose. While establishing the trust, the trustor has to name which of their assets are to be managed, it could be their money, house, business, or any other asset they wish to transfer to the beneficiaries.

- Appointing a Trustee: While establishing the trust, the trustor also has to name their trustees. The trustee can be anyone, a person, their partner, or even organizations and financial institutes. The job of the trustee is to manage the trust and its assets per the trustor’s wishes. The trustors themselves can also appoint themselves as the trustee till they are alive and well, but they must name a successor after them who will continue their will.

- Setting the Terms of the Trust: One of the main things that the trustor has to do while establishing the trust is to set the terms of the trust, which means they have to clearly define how they want their assets to be used and given. They can set certain milestones, or age limits like when the kids start college, or when their children become 18 or anything they believe is the right time.

- Designating Beneficiaries: The most important thing, assigning the beneficiaries who will receive the assets in the trust. Beneficiaries can be anyone the trustor assigns, it can be their children, spouse, family members, friends, or charitable organizations. While assigning them, they also set certain conditions under which the beneficiary will receive the assets.

- Allocating Assets: If there is more than one beneficiary, the trustee can also divide their assets to make sure everyone receives something as per their wishes.

Who Is a Trustee?

The trustee is assigned by the trustor in order to manage and carry out the trustor’s will per their wishes. A trustee can be a person, family member, bank, or any other entity that the trustor deems fit for the role.

The trustee has to carry out the responsibilities laid by the trustor in the will and make sure everything goes per the arrangement. They are also responsible for distributing the assets to the beneficiaries per the trustor’s wishes.

Key Responsibilities:

- Managing Assets: The trustee carries the role of the asset manager. They have the power to make decisions that they believe will be more beneficial for the ideas that the trustor had. They can also sell the assets in case the trustor becomes incapacitated to use the amount for their treatment.

- Asset Distribution: One of the key roles of a trustee is to distribute the assets in trust to the beneficiary per the wishes of the trustor. This includes providing them the said assets after whatever conditions were set during establishing the trust, it could be after their death, after a certain age, or under specific conditions.

- Handling Taxes and Bills: The trustee may be responsible for handling current tasks if the trustor is unable to perform them. It includes tasks like filing for taxes, handling current expenses, or covering the trustor’s healthcare costs.

- Acting as a Fiduciary: The trustee has been trusted by the trustor to handle the responsibilities of their assets and beneficiaries. They have to carry out these roles without any personal interest or bias and act with the best interest of both in mind. This is known as Fiduciary duties. If the trustee acts against it, they can be held responsible and be open against legal actions.

- Administering the Trust: Once the assets and responsibilities of the trust are passed to the trustee, they are the ones responsible for handling every task on the agreement. They have to take care of the beneficiaries, and their assets, and make sure that everything on the will is going according to the trustor’s wishes.

READ MORE Private Equity Investment Trusts: Meaning and How They Work

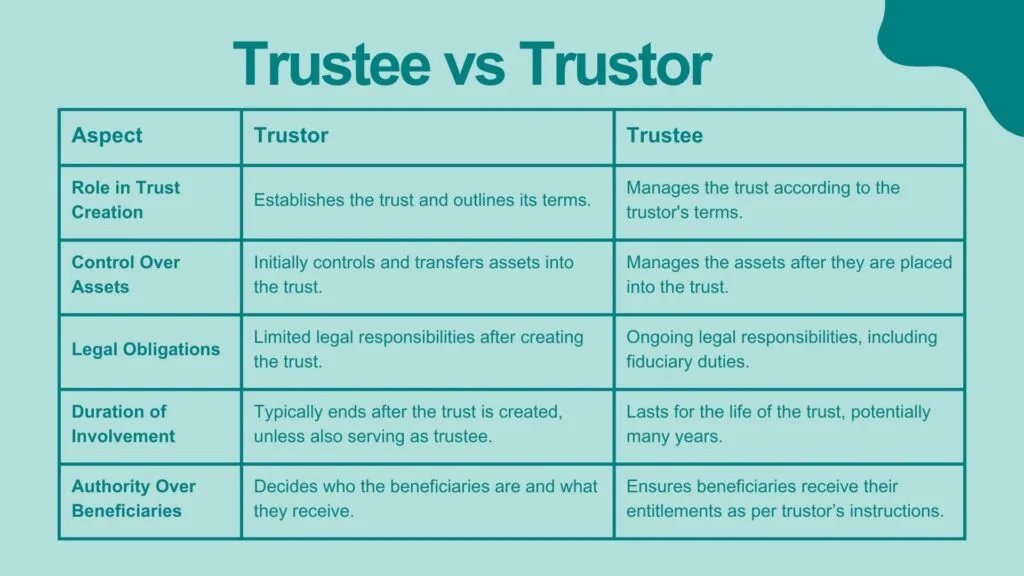

Trustee vs Trustor

1. Role in Trust

The trustor is the key that creates the trust. The trustor determines what trust will cover, what assets are to be included, and how the trust is to be managed. They are one that outlines how their assets are to be used, when the beneficiaries can receive the assets, and how to handle their expenses. They are also the ones who decide on who is to be considered as the trustee after them.

On the other hand, a trustee plays a different role. The trustee comes into play after the trustor is deceased or becomes incapacitated and cannot handle the trust matters. The trustee has to manage and control the trust and make sure that everything goes according to the trustor’s plan.

2. Control Over Assets

The trustor is one who owns all of the assets, but that changes once they have created and locked their assets into a trust. Of Course, the trust doesn’t gain control over the assets, not anyone till the trustor is alive and well enough to manage it themself. But after that, their assets go to the trust and the trustee to be managed. The trustors are essentially giving up their control over the assets to protect these assets in the future for their beneficiaries.

The trustee gains control over the asset after the trustor passes away or is not able to handle it anymore. The trustee has to carry out the wishes of the trustor and manage the assets accordingly.

3. Legal Obligations

The Trustor’s legal duties are setting up the trust, naming the beneficiaries, naming the trustees, outlining how the trust has to manage their assets, and including all the assets they wish to set in the trust.

Whereas the trustee has ongoing legal obligations. They have a fiduciary duty, which means they have to act in the best interest of the assets and their beneficiaries.

4. Duration of Involvement

Trustor’s involvement in the trust is mostly till the terms and conditions are set, after that, their role is completed. Unless they name themselves as the trustee till they are alive and well, their roles and involvement are limited till the start. But if they are also the beneficiaries, then their role continues further.

On the other hand, the trustee’s involvement begins after the trustor cannot continue anymore, and it continues till every asset of the trust has been passed on to the beneficiaries.

5. Authority Over Beneficiaries

Trustor has to assign their beneficiaries who will receive the assets after them. They also have to set the terms and conditions on how and when the beneficiaries can receive the assets.

The trustee has no authority over the beneficiaries, but they are in charge of everything concerning the beneficiary’s claim over the asset.

READ MORE Top 10 Financial Literacy Books Recommended for Beginners

Frequently Asked Questions (FAQs)

What is the difference between a trustor and a trustee?

A trustor is one who sets up the trust, assigns the trustee and beneficiaries, and outlines the guidelines for the trust. On the other hand, the trustee is the one who manages the trust after the trustor and ensures that the terms and conditions set by the trustor are followed.

Who has more power, a trustor or trustee?

The trustor has the power in the start before the trust is set up, but once the trust is established, the power is transferred to the trustee.

Is a trustee the same as an owner?

No, the trustee is someone that the trustor has assigned as the person who will manage their assets after them. However, the owner can assign themselves as the trustee till they are deceased or incapacitated.

Final Statement

Both trustor and trustee are the key to establishing and managing the trust. They are the ones handling everything from start to finish till the beneficiaries receive their assets. But both of them have very different roles and responsibilities to carry out.

The trustor has to set up the trust, including every detail about how things are to be managed, what assets they wish to include, who are their beneficiaries, and who will be the trustee handling the trust and making sure their wishes are being carried out perfectly. Meanwhile, the trustee’s work kicks in after the trust has been established. They have the goal and the guideline to reach the goal, they have to act in the best interest about how these assets are to be managed and also make sure the beneficiaries receive them as per the intention of the trustor.

Whether you are the trustor or the trustee, I hope this article is helpful and informative enough to help you make your decision and learn about the roles and responsibilities of both roles.