One of the basics that confuse many people in accounting is the debit and credit entries. As the entries aren’t explained in many books, teachers tend to teach this at the start using the DEALER concept. And if you have missed it or forgotten it, don’t worry; we have you covered.

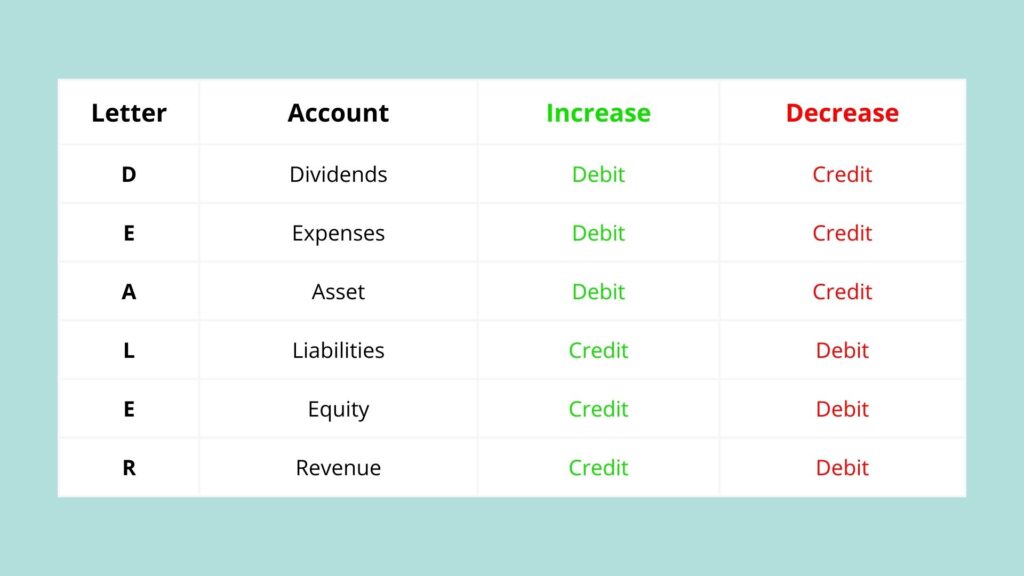

DEALER stands for Dividends, Expenses, Assets, Liabilities, Equity, and Revenue. The six letters in the acronym represent different types of financial transactions that help us determine where to categorize these entries based on their type. The Dividends, Expenses, and Assets go on the debit side, and the Liabilities, Equity, and Revenue go on the credit side. So, you can remember it as the first 3 letters represent the debit side, and the last 3 represent the credit side.

The article explores the concept in depth and provides many valuable things, from the basic concept and its components to how it is used to prepare the final accounts.

READ MORE The Golden Rules of Accounting – The 3 Rules

Understanding the DEALER Accounting Equation

The concept closely follows the equation :

Assets = Liabilities + Equity

The DEALER concept expands on this equation by categorizing the transactions from the debit and credit side into 6 different sections. Each category within DEALER comes into one of two categories: Debit Increases (Dividends, Expenses, and Assets) and Credit increases (Liabilities, Equity, and Revenue). Let’s take a deeper look at this:

Debit Side: Whenever you see a transaction that increases in these categories – Dividends, Expenses, and Assets – you increase/record their transaction on the debit side. For instance, if you see a transaction about a firm buying machinery, it is categorized as an asset, so you will record this entry on the debit side.

Credit Side: Whenever you see a transaction from these categories – Liabilities, Equity, and Revenue – you record them in the credit side. For instance, if you see a transaction for income credited, this comes under the revenue section, so you record the transaction on the credit side.

Understanding the DEALER concept, including the acronyms, is all you need to do to memorize how the entry system in accounting works. So just remember, the first 3 letters are for debit, the other 3 for credit.

Components of DEALER

Let’s get into details about each of the six categories and what they are. Once you learn how to categorize every transaction, you will learn to categorize and record them properly just by seeing the names in the transaction.

Debit Side of DEALER: Dividends, Expenses, and Assets

- Dividends: Dividends are the bonus payments the company pays their shareholders for their investment and trust in the company. As the dividend amount is to be deducted from the company’s account, it comes under the debit section.

- Expenses: Every expense that occurs within the business related to raw materials, salaries, rent, bills, and other items that the company uses its money for its operations must be taken out of the company account, so you record them on the debit side.

- Assets: Assets are the company-owned resources that help them create value; these include things like land, machinery, buildings, and other cash equivalents. These are to be recorded on the debit side of the journal as they are to be deducted from company accounts.

Credit Side of DEALER: Liabilities, Equity, and Revenue

- Liabilities: Liabilities include the amount the company owes to others, such as debt obligations, loans, or accounts payable. These are the debts or promises that the business has to pay after some time by any means, whether by cash or by assets. These transactions are recorded on the credit side because the business’s debt obligation increases the amount the business owes, balancing the debit side, which shows the increase in assets.

- Equity: Equity is the owner’s capital invested in the business. It includes the owner’s capital and the retained and reinvested amount. When equity increases, it shows that the business is becoming more valuable. These transactions are recorded on the credit side of the journal because equality represents a source of financing for the business.

- Revenue: Revenue is the income the business generates from business operations, like sales or service income. It is recorded on the credit side.

How DEALER Aids in Final Accounts

Clarity in Recording Transactions

The DEALER concepts help simplify the debit and credit side, making it easier to classify and record them correctly. With such an easy way to remember and classify all transactions, even people who are new to the account can easily classify them based on the six listed categories.

Simplifying Account Balances

When preparing the final account, it’s very important to record all transactions at their proper place, or else the final account won’t balance. This is one of the most common problems people face, as the final account doesn’t balance. But with the help of the DEALER concept, things are made easier, and the chances of this mistake are reduced, providing a systematic way to aggregate transactions.

Enhanced Financial Reporting

Thanks to the DEALER concept, the final account will display a more accurate final report with fewer mistakes and more accuracy. This report represents the company’s financial performance to its stakeholders. With accurate reports, stakeholders will better understand the firm’s performance.

Effective Budgeting and Forecasting

The DEALER concepts help to understand how various transactions affect the various accounts; this can be an important factor that helps the company with budgeting and forecasting. Companies get more accurate data using the DEALER concept that can be used to identify trends in income, expenses, and other financial aspects, which ultimately help them make better investment decisions and devise effective costing strategies.

Identifying Areas for Improvement

Using the DEALER concept, companies get a more accurate final account; businesses can identify areas with extra and higher costs and recognize areas with opportunities where the revenue can be increased.

READ MORE Administrative Accounting : Functions, Importance, Tools and Techniques

Frequently Asked Questions (FAQ)

What does DEALER stand for in accounting?

DEALER is an acronym that helps categorize accounting transactions into credit and debit sides.

Debits

Equity

Assets

Liabilities

Expenses

Revenue

How does the DEALER concept help in bookkeeping?

The DEALER concept helps accountants simplify the journal entries by explaining what transactions are to be recorded on the debit side and which ones are to be recorded on the credit side.