Investment is one of the passive ways of creating wealth and saving for your future. Still, as easy as it may sound, it isn’t easy, especially for beginners. Today, we have many options available for investment – stocks, bonds, high-yielding savings accounts, and money market accounts, but the most popular options right now are stocks and exchange-traded funds, also known as ETFs.

Both stocks and ETFs have different selling points; they provide to different types of people with different investment goals. In this article, we will have a comparative study of stocks vs ETFs, which means we will discuss their characteristics, benefits, and drawbacks and help you choose the right investment option for you based on your financial objectives.

ALSO READ : 5 Steps in Investment Decision Process for Successful Gains

1. Understanding Stocks

What are Stocks?

Stocks are assets that represent ownership in public companies that are trying to raise capital through the stock market. When you purchase stock in a company, it represents that you have bought a small part of that company. Now, you are entitled as the company’s owner and will also earn income from the stocks you brought. There are 2 types of stocks :

- Common Stocks: These stocks are, as the name suggests, common and mainly traded on the stock market. Common stock allows the owner to have voting rights in the company matter at shareholders’ meetings. Common stockholders can receive dividends when the company makes profits. Most importantly, common stocks have the potential to increase in value and give higher returns.

- Preferred Stocks: Preferred stocks have different rights than common stocks. Preferred stockholders do not have the right to vote in the shareholders’ meetings. However, these stockholders are a priority for the company and have the right to claim their stocks before common stockholders, especially in case of liquidity.

How Stocks Work

When a company needs to raise capital and they qualify and meet all the stock market needs to be considered as a public company, they can issue their company shares to people through IPO – Initial Public Offerings. Once issued for IPO, the company stocks are traded on standard exchanges like NASDAQ or New York Stock Exchange (NYSE). Once on the market, the share price of the company fluctuates based on the company’s performance and market volatility.

Advantages of Investing in Stocks

Higher Returns

Stocks have always provided a high rate of return when we compare stocks vs ETFs. However, not only ETFs but also stocks have been the assets that provide the highest return compared to any other investment options. This can be an attractive quality for long-term investors who want to build long-term wealth.

Ownership in a Company

Stocks give every individual an opportunity to be an investor and owner of a part of the company. It means you become a stakeholder of the company, who has the right to vote in public matters and the right to earn profits on your shares.

Dividend Income

A dividend is a payment a company makes to the stockholders when they earn a profit. It can be considered a thank you from the company for the stockholders’ trust. Dividends provide a regular income source for the stockholders.

Liquidity

One of the main advantages of stock for investors is its liquidity. Stock is very liquid and, hence, can be cashed out whenever the investor needs it.

Drawbacks of Investing in Stocks

Volatility

The stock market is a highly volatile place, which means the stock prices can fluctuate strongly based on market conditions and economic indicators. This means a stock hovering over $1000 per stock today can move to $800 the very next day if the market falls.

Company-Related Risks

Investing in company-specific stock has the risk of poor company performance due to internal problems. A company having internal problems such as poor management or financial conditions will provide no long-term gains and is most likely to lose your investment in the long term.

Time-consuming Research

When investing in stocks, investors have to thoroughly research several factors, such as market research, industry research, and company research. To research serval markets and industries to identify the most profitable and then assess which company to invest in. It is a long and tedious process.

Emotional Stress

The stock market can be profitable and incur losses; significant losses can lead to stress and impair your decision-making process.

2. Understanding ETFs

What are ETFs?

Exchange Traded Funds or ETFs are investment capital that has a number of different assets, such as bonds and stocks, all available in one place. ETFs are also traded on a centralised exchange, just like stocks, where traders are allowed to trade their assets anytime on a trading day. EFTs offer investors a wide range of classes and investment strategies in one place.

How ETFs Work?

Exchange-traded funds are created by financial institutions known as the sponsors. These sponsors assemble a portfolio of assets in one place and then issue the shares of ETF, which are sold to investors. All these assets can be traded on the stock exchange during trading time. ETFs can be passively managed, tracking an index like the S&P 500, or actively managed with the help of a fund manager who will make all the investment decisions.

Benefits of Investing in ETFs

Diversification

ETFs mitigate the risk involved while investing in individual security by holding all the assets in one place in a diversified portfolio. Such broad exposure helps to mitigate the risk across various sectors, industries, or security groups.

Cost-Effectiveness

ETFs usually have very few expenses, making them a very cost-effective investment option. This is especially true for passively managed ETFs that track indices.

Liquidity and Flexibility

ETFs are available to buy or sell throughout the complete trading day, which gives investors the chance to sell or buy them as they please.

Transparency

ETFs disclose their holdings at regular intervals to ensure that investors are aware of the assets they own. This helps the investor to make a more informed decision.

Transparency

ETFs disclose their holdings at regular intervals to ensure that investors are aware of the assets they own. This helps the investor to make a more informed decision.

Tax Benefits

ETFs have a unique redemption process and very different structures, which makes them more tax-efficient than other similar options.

Drawbacks of Investing in ETFs

Tracking Error

Sometimes, ETFs can have errors while reflecting the performance of their underlying index, which results in tracking errors. This error can occur due to fees, trading costs, and imperfect replication strategies.

Market Risks

Even though ETFs provide a diversified portfolio, which mitigates the risk factor, they are still subject to market risks and economic conditions. If the market fluctuates and declines, so will the exchange-traded funds.

Complexity

ETFs have a variety in their holdings, which makes it difficult for investors to choose from, especially beginners. Investors need to understand each of the strategies and holdings of ETFs to make sure they can make a good decision.

Trading Costs

Even though the general expense ratio on ETFs is lower, frequent trading on ETFs can incur commission continuously, which can result in lower returns.

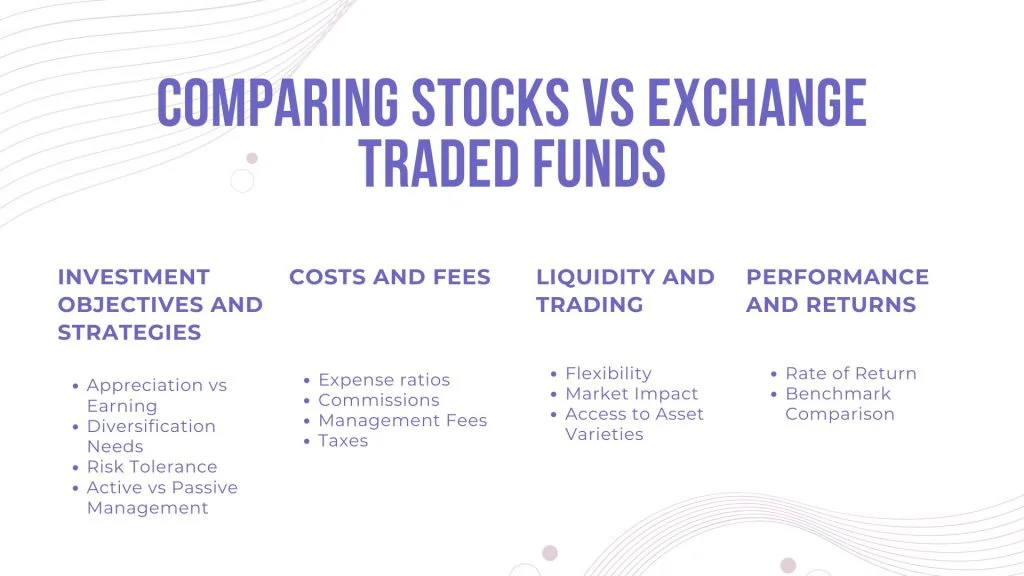

3. Comparing Stocks vs ETFs

Investment Objectives and Strategies

Appreciation vs Earning

Investors prefer stocks for long-term investment as they tend to appreciate the principal amount over time.

On the other hand, ETFs are more focused on income-generating assets such as bonds and dividends, which provide a regular income.

Diversification Needs

Investors interested in stocks have to do extensive research on the market, industry, and various companies and then monitor them regularly to achieve a diversified portfolio.

ETFs provide a pool of securities in one place, which eliminates the need for extensive research like we have to do in the case of stocks.

Risk Tolerance

The stock market is a very volatile place, every stock is subject to market risk, which makes the stock a highly volatile option. Stocks offer great returns in a high-risk environment.

In the case of Stocks vs ETFs, ETFs are the more balanced and moderately risky option. ETFs offer a balanced portfolio to investors, which means ETFs make a pool of investments like mutual funds and diversify the risk, making it less risky than stocks.

Active vs Passive Management

Investors who are actively monitoring the stock market prefer to go for individual stocks where they believe the long-term profit can be greater.

Investors who prefer passive investment strategies prefer to go for ETFs.

Costs and Fees

Expense ratios

When we talk about Stocks vs ETFs, ETFs have a lower expense ratio, but stock, on the other hand, has no expense ratio.

Commissions

Buying and selling in ETFs incur costs every time an investor makes a trade, which makes ETFs a very expensive option compared to stocks. Meanwhile, we have arrived at a time where, in many places, brokers have started to offer commission trading platforms.

Management Fees

In the case of management fees for Stocks vs ETFs, ETFs clearly have higher management fees than stocks because investing in stocks requires no management fees.

Taxes

Finally, for the last Stocks vs ETFs in terms of costs and fees, ETFs are more tax-efficient due to their different redemption processes and structures. On the other hand, taxes are incurred when stocks are sold.

Liquidity and Trading

Flexibility

Both stocks and ETFs are very flexible when it comes to being traded throughout a trading day. However, ETFs offer the additional benefit of instant diversification.

Market Impact

Stocks are an individual entity, which makes them a very desirable investment avenue. So, people usually trade them in large numbers to earn more. When a large number of stocks of the same security are traded, the prices of securities are greatly influenced. Meanwhile, due to the diversified nature of ETFs, they are not influenced heavily by such trades.

Access to Asset Varieties

And finally, for Stocks vs ETFs in liquidity and trading, As stocks are a singular entity, there are few options for investors. On the other hand, ETFs offer a wide range of securities to trade for, as they have all the assets available in one place.

Performance and Returns

Rate of Return

When we talk about stocks vs ETFs, Stocks have always been the first option for higher return on investment. Stocks offer a high return on investment, but they come at the risk of a highly volatile market.

The other option in stocks vs ETFs, ETF is a fund of investment that diversifies across various investment options, which divides and mitigates the risk associated with the investment, providing a moderate balance between risk and return. ETFs provide a moderate return on long-term investments.

Benchmark Comparison

When we talk about benchmarks for stocks vs ETFs, stocks have no benchmarks. Stocks are individual entities; they don’t follow any entity; they fluctuate according to the market and company performance.

For ETFs, they use indices or other benchmarks to compare their performance and prices.

4. Making the Right Investment Choice

Assessing Your Financial Objectives

Short-Term vs Long-Term Goals

Stocks vs ETFs both cater to different groups of investors with different investment objectives. Stocks are an investment option that is suitable for investors who have long-term goals and a high-risk tolerance.

ETFs are very similar to mutual funds, and they are suited for both long-term and short-term investments. However, the return is lower when we compare stocks vs ETFs. ETFs offer a moderate rate of return with less risk than stocks.

Income Needs

Based on investors’ needs, they choose to select from stocks or ETFs. If investors plan to invest for a long time with the potential for huge growth in the future, they must opt for stocks. If the investor needs regular income and dividend-based earnings, then ETFs are the way to go.

Risk Tolerance

As an investor, you should know your limits, limits in investment, and risk. When discussing stocks vs ETFs, Stocks are the risky option. Stocks are subject to market risk and company risk, which is why they offer a higher rate of return in the long term as a reward for your risk.

However, ETFs provide investors with a moderately risky option. The diversified nature of ETFs makes them a desirable investment option for people who want to invest in the market but want to take little risk.

Conducting Research and Analysis

Stocks vs ETFs Analysis

In stocks vs ETFs, both have different factors that need to be analysed before making an investment decision. In the case of stocks, investors have to analyse the market, industry, and then finally, the company. Company analysis entails assessing the company’s financial health, management, growth opportunities, and industrial reputation.

For the second half of stocks vs ETFs, ETFs are analysed on the basis of their past performance, expense ratio, and, most importantly, the underlying asset.

Market Conditions

This is for every investor out there. When comparing stocks vs ETFs or any other investment options, always study the market condition. You can evaluate the market condition by assessing the economic indicators, market indices, technical indicators, and geopolitical events and using SWOT analysis.

Diversifying Your Portfolio

The Balanced Approach

One of the best approaches to diversify risk is to combine ETFs and stock and create a balanced portfolio.

Asset Allocation

As an investor, make sure you select the right amount of stocks, bonds, T-Bills and other investment avenues based on your investment objective to create a perfectly mixed and balanced portfolio.

Regular Monitoring and Upgrading

Once you created your perfect portfolio, be sure to check on it at regular intervals to make sure that your investment is moving towards your investment goals. If there are any disparities, like a stock dropping drastically, make sure that you select other similar stocks and keep your portfolio in the best shape.

ALSO READ : What are Economic Indicators? Here’s The 6 Most Important Economic Indicators

5. FAQs

Is ETF better than stocks?

ETFs are a better option for investors who have moderate risk tolerance and are satisfied with moderate returns. ETFs offer tax-efficient trading, a balanced portfolio, high flexibility in trading, and transparency from the institution.

Which are riskier stocks or ETFs?

If we compare stocks vs ETFs, stocks are clearly the riskier option. Stocks are subject to market risks and company risks. Meanwhile, ETFs are diversified investments where the risk is reduced because of the diversification.

What are the disadvantages of ETFs?

Exchange Traded Funds or ETFs are investment capital that has a number of different assets, such as bonds and stocks, all available in one place. Even though they offer great benefits, there are certain disadvantages. They are :

Trading Costs

Market Risks

Complexity

Tracking Error

6. Final Statement

Stocks and ETFs offer different investors with different needs. Stocks are an individual security option for investors who want high returns in the long term and have a high-risk tolerance. ETFs cater to different types of investor groups. Investors with low-moderate risk tolerance and aiming for a moderate level of earnings should opt for ETFs.

The final choice from stocks vs ETFs depends on the investor and their final goal. There are several things to consider when selecting one of the two, which include factors like financial goal and risk tolerance. We have explored all the possible features, advantages, and drawbacks of both Stocks and ETFs to make sure you can make a much more informed decision for investment.

Lastly, Whatever investment option you select, whether it is stocks, ETFs, or a combination of both, make sure you conduct thorough research on every influencing factor before making a decision, and ensure that you keep reviewing your portfolio and updating it as per the needs.

I hope this article on stocks vs. ETFs was informative and helpful in helping you choose the right investment option. If you have any doubts or suggestions, let me know in the comment section.