Saving is considered the key to a stress-free life. When it comes to saving, there are many plans and tactics out there in the market. Every plan offers a unique approach and saving method.

The saving percentage rule is one of the methods that uses a divide and save approach. This post will serve as a guide that will help you understand what the saving percentage rule is and how to implement it.

What is the Saving Percentage Rule?

The saving percentage rule is a financial strategy for saving your after-tax income by regularly saving a certain percentage of your income. In this approach, the income is divided into three portions: 50/30/20.

- 50% for basic needs such as rent, electricity bills, groceries, transportation, and healthcare.

- 30% for wants like hobbies, dinners, or vacations.

- 20% for Savings and Debt Payments.

ALSO READ ABOUT 8 Important Steps for Personal Finance for Beginners

Understanding the Saving Percentage Rule

50% for Needs

50%, which means half of your after-tax income is to be allocated to your basic needs. Basic needs include housing, rent, groceries, bills, EMI, transportation, and healthcare.

50% of your income is the estimated range per the plan that you should spend on your basic needs. If you need more than that, you can move to cheaper options to ensure that you can spend as per the 50% rule.

Cheaper options mean moving to a more affordable brand for your basics and spending less on transportation by using shared options or public transportation. You can reduce your outings for dinner and lunch and try to eat more at home. Simple practices like turning off your lights and other appliances when not in use can also help reduce your bills.

If your budget exceeds 50% even after cutting all extra expenses, you should consider a different type of savings method. Otherwise, you will have to cut your “wants” section down to manage your basic needs.

30% for Wants

The second section of the 30% is allocated for your ‘wants’. Wants are beyond your basic needs. These are the things you don’t need for survival. This 30% is allotted for things that you want to buy out of desire, such as new shoes, a gym membership, or a new TV set.

This category is completely allotted for new things or upgrades that you want. As humans, we may survive with the basics, but we earn so we can afford things that we like. So, 30% of your income is the reward for your work.

Even though we have allotted 30% to wants, you cannot afford everything in those 30%. Sometimes, these things you desire can be out of the budget. In such cases, you will have to use the basic tactic of saving.

Suppose you are planning a 12-day vacation. You cannot save enough from the allotted 30% to pay for a 12-day stay somewhere else. In such cases, you can save a portion from your allotted 30% and plan your vacation after a few months until you have more than enough budget for your vacation. This strategy applies to all expense desires, whether a vacation or a new refrigerator.

The things allotted for this slot include your monthly PS Plus subscription, the highest broadband plans, vacations, a new mobile device, a ticket to games, etc.

20% for Savings and Debt Management

Lastly, 20% of your income is allotted for savings, investments, and debt payments. The last 20% of your income has to be divided into these three sections per the requirement.

The first part of this section has to be allotted for emergency funds. An emergency fund is savings that can cover your monthly expenses. Make a target of saving at least 3 months of emergency funds. An ideal position would be 3-6 months of savings. This will ensure you are prepared for any financial emergency.

If you have a debt with a high interest payment, prioritize it. These high-interest debts will only cause more financial trouble in the future, so it is better to target and eliminate them first.

Saving from these 20% differs from the one we discussed in the 30% slot. These savings are focused on saving up for big purchases, such as houses, cars, or other big purchases.

Lastly, the remaining part will be added to your savings or investment. It is recommended that you invest your savings according to your risk-taking ability. If you have time to research, aim for a high-risk, high-reward investment. If you want a safe option, go for a high-yielding savings account or Fixed deposits.

Ensure you have planned insurance to fit into this budget. Although it may seem like a waste for now, insurance is a huge help in emergencies and retirement.

Importance of the Saving Percentage Rule

1. Financial Discipline

The saving percentage rule keeps filling you with discipline as you start following it. Once you follow the saving percentage rule, with time, your mind will be automated to spend as per your plan. It will help you prioritize your spending and avoid unnecessary things.

It’s not just about your basic needs, the goal of buying something you want, or saving up for your big purchase; the saving percentage rule instils these factors in your mind so you can stay focused on your ultimate goal.

2. Emergency Fund Build-Up

An emergency fund is a part of your 20% portion. Once you have an emergency fund for 3-6 months, you will have created a virtual layer of protection that will help you in financially troubling times.

Suppose you lose your job. Three to six months’ worth of emergency funds will help you live the same way you do even while you are unemployed and searching for a job.

3. Debt Reduction

If used correctly, the saving percentage rule can be a huge help in debt management. You can prioritize and eliminate your high-interest debts. Allocating a part of your income to debt repayment reduces your liabilities and improves your financial health.

4. Future Security

The primary goal of every savings plan, including the saving percentage rule, is to provide a financially secure future. The 20% saving percentage rule aims toward savings. That savings helps individuals to purchase their dream house, car, and other goals.

It ensures a financially free future in which you can afford education for your kids, secure a retirement, and do all this without any debt for you or your family.

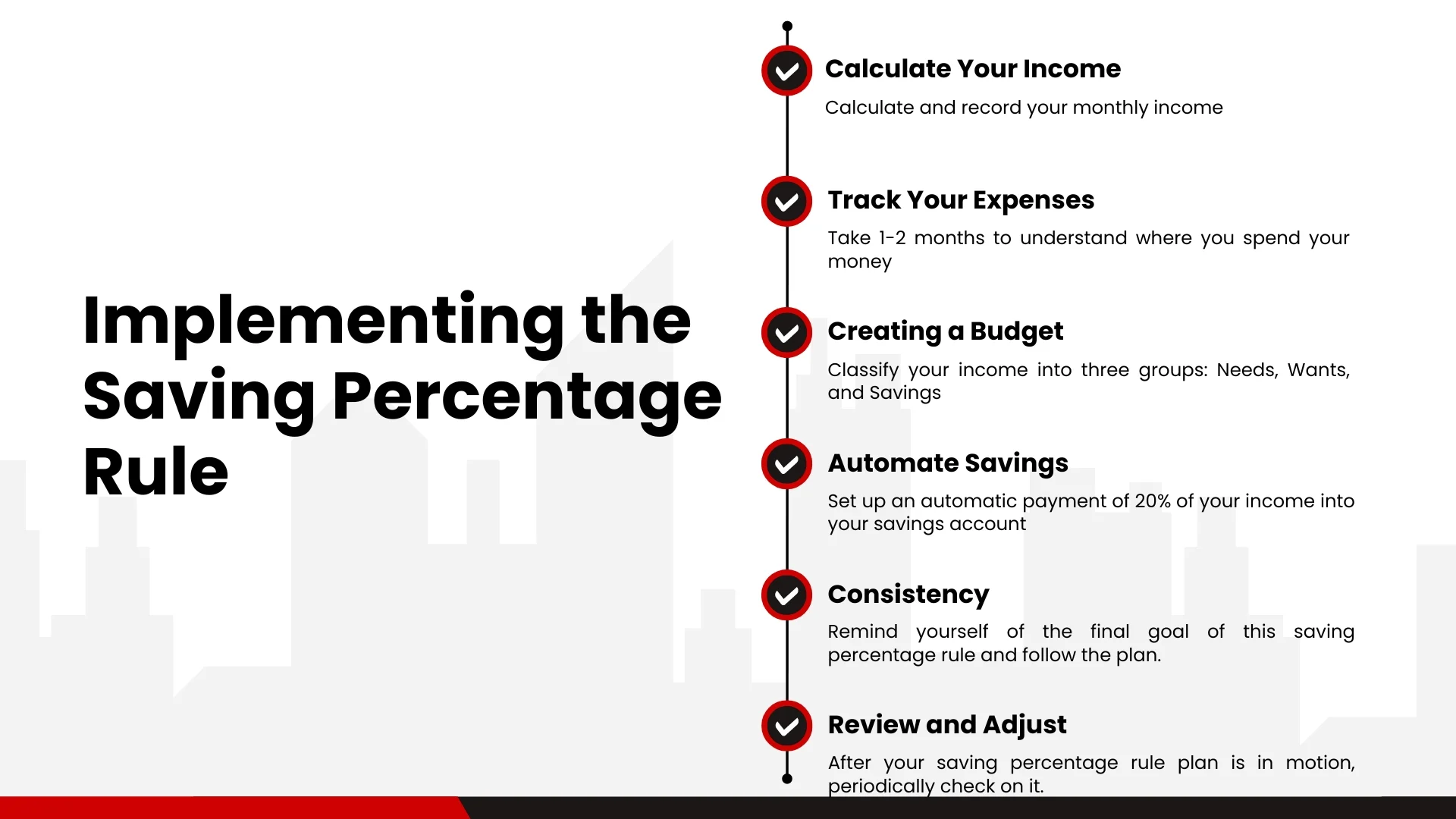

Implementing the Saving Percentage Rule

Knowing the saving percentage rule and implementing it in real life is a little different. Before starting your 50-30-20 saving method, you need to do some basic work. Here are the essentials for the 50-30-20 rule:

1. Calculate Your Income

The first and foremost step in applying the saving percentage rule is to calculate and record your monthly income. This means you have to consider your after-tax income that is credited to your account. Once you have your income on paper, you will be more informed and prepared to create the sections for the 50-30-20 method.

2. Track Your Expenses

One of the deciding factors in this saving percentage rule is to understand your spending habits. Take 1-2 months to understand where you spend your money. This includes every payment you make, including your haircut, rent, groceries, dining, transportation costs, etc.

Once you have created a list of every expenditure in these months, you will be prepared to make a budget using this list for your data. To store the expenditure data, you can use a book, your phone’s notepad, or spreadsheets.

3. Creating a Budget

With all the data you have collected in 2 months, you can classify your income into three groups: Needs, Wants, and Savings. Separate your basic needs into the first category, your extra or non-essentials into the second category, and create a direct allotment of 20% for the last category.

Ensure your essentials, such as rent, EMI, mortgage payment, and other non-negotiable expenses are prioritized. These expenses are not avoidable and should be prompt. If your expenses exceed the allotted category, you will have to adjust your spending habits to ensure that you adhere to the saving percentage rule.

4. Automate Savings

If you set up an automatic payment of 20% of your income into your savings account, it becomes easier for you to categorize them. This ensures that your account will be credited at a specific date.

Once your savings account is credited with the 20%, your income account becomes easier to manage.

5. Consistency

Once you have started planning and spending according to the saving percentage rule, it’s up to you to stay disciplined and continue the plan. Starting something is easy, but the hard part is maintaining it. The 50-30-20 rule needs strict discipline for long-term success.

You can use mind tactics to ensure that you stick to your budget and do not give in to the desire to spend on things you want. Remind yourself of the final goal of this saving percentage rule.

6. Review and Adjust

After your saving percentage rule plan is in motion, periodically check on it. Make sure that everything is going as per your plan.

If your financial situation has changed, such as an increase in income, then alter the 50-30-20 plan according to your income. Start by tracking your expenses, just like you did at the start of the saving percentage rule.

ALSO READ ABOUT 8 Effective Strategies to Improve Your Financial Health

FAQs

What is the 70-20-10 budget rule?

The 70-20-10 budget rule suggests allocating 70% of your income to living expenses and necessities, 20% to savings and investments, and 10% to debt repayment or charitable donations. This rule helps in managing finances by ensuring a balanced approach to spending, saving, and giving.

What is the 60-20-20 saving rule?

The 50-30-20 rule for savings is a budgeting method where 50% of your income is allocated to essential needs, 30% to discretionary wants, and 20% to savings and debt repayment. This approach helps maintain a balanced and sustainable financial plan.

What is the 50-30-20 rule for savings?

The 50-30-20 rule for savings is a budgeting method where 50% of your income is allocated to essential needs, 30% to discretionary wants, and 20% to savings and debt repayment. This approach helps maintain a balanced and sustainable financial plan.

What is the 40-40-20 budget rule?

The 40-40-20 budget rule is a financial strategy where 40% of your income is dedicated to essential expenses, 40% to discretionary spending, and 20% to savings and debt repayment. This method provides more flexibility for personal spending while still prioritizing savings and financial obligations.

Final Statement

The saving percentage rule is a powerful tool for saving and securing a financially free future. By consistently saving a portion of your income, you can build an emergency fund, pay off debt, and secure your financial future.

Implementing this rule requires discipline, budgeting, and periodic review, but the long-term benefits far outweigh the effort. Start today and take control of your financial destiny.

I hope this post on the saving percentage rule was informative. If you need any help, let us know in the comment section.