Last updated on August 5th, 2024 at 12:59 pm

The Economy of a country refers to their structure of production, distribution, and consumption of goods and services. The main components of a country’s economy are its employment, income, inflation, and economic growth. These economic components help us understand a country’s economic condition.

In this article, We will discuss what are economic indicators and how they help us in detail.

What is an Economic Indicator?

An economic indicator is a data point that helps us understand an economy’s health and the direction it’s headed. These indicators help economists, businesses, and investors to analyse a country’s economic conditions and predict future trends.

These are some of the most commonly used economic indicators :

- Gross Domestic Product (GDP)

- Unemployment Rate

- Inflation Rate

- Consumer Price Index (CPI)

- Interest Rates

- Stock Market Indices

ALSO READ : 8 Importance of Balance Of Payment You should be aware of

Gross Domestic Product (GDP)

Gross Domestic Product or The GDP of a country is the most widely known economic indicator. Gross Domestic Product refers to the total production of goods and services of a country over a certain period of time, a year or quarter. Generally, a growing GDP is a sign of a growing economy and declining GDP is a shrinking of the country’s economy.

Unemployment Rate

The unemployment rate indicates the percentage of human capital that is unemployed and is actively seeking job opportunity. This is another one of the major economic indicators as it explains the labour situation in the market and overall economic vitality. Higher unemployment rate indicates economic shrinkage, meanwhile a lower unemployment rate indicates a flourishing economy with several job opportunities in the market.

Inflation Rate

The inflation rate of a country signifies the increase in the general rate of goods and services of that country. We can analyse fluctuation in inflation by studying the Consumer Price Index (CPI) or the Producer Price Index (PPI). A moderate level of inflation is considered the optimal level as it indicates that consumers have the capacity to spend and invest. A high inflation rate indicates that the Purchase Power Parity (PPP) of the country is low, which means the consumers are not able to afford a lot and hence the economy is moving towards shrinkage.

Consumer Price Index (CPI)

The Consumer Price Index analyses the fluctuations in the prices of the consumer goods such as food, housing, and transportation for urban consumers. This is one of the key economic indicators of inflationary pressure and is closely monitored by the central government. A higher CPI can trigger a hike in interest rate to curb inflation. On the other hand, a lower CPI can cut rates and help in economic growth.

Interest Rates

Interest rates are decided by the government/ central banks, they determine the interest rate on loans and returns on savings. Interest rate plays a very influencing role in consumer spending, investments, and inflationary pressure. A high interest rate tends to reduce loans and investment which stops the growth of the economy, meanwhile a lower interest rate encourages people to borrow loans and invest more which helps to boost economic activities.

Stock Market Indices

The stock market indices such as The Dow Jones Industrial Average, The NASDAQ, S&P500, they analyse the performance of publicly traded companies. A bullish market, when the market prices are in boom or rising is considered as a stride towards economic growth. A bearish market, when the prices of the stocks are falling indicates a fall in the economy.

Types of Economic Indicators

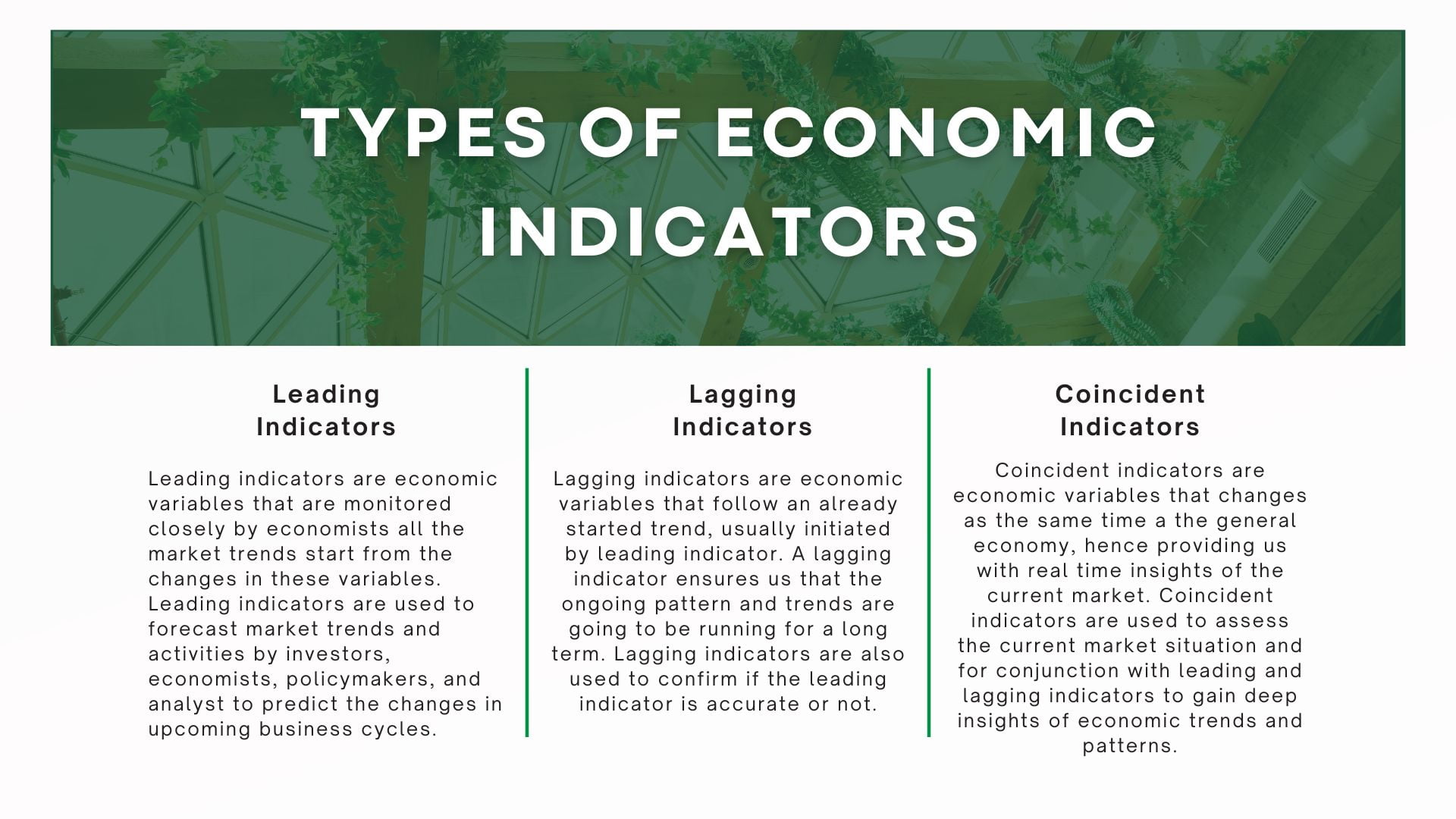

There are 3 types of economic indicators, they are –

- Leading Indicators

- Lagging Indicators

- Coincident Indicators

Leading Indicators

Leading indicators are economic variables that are monitored closely by economists. All the market trends start from the changes in these variables. Leading indicators are used to forecast market trends and activities by investors, economists, policymakers, and analysts to predict the changes in upcoming business cycles. Some of the widely known leading indicators are as follow :

- Stock Market Indices

- Building Permits

- Consumer Confidence Index

Lagging Indicators

Lagging indicators are economic variables that follow an already started trend, usually initiated by a leading indicator. A lagging indicator ensures us that the ongoing pattern and trends are going to be running for a long term. Lagging indicators are also used to confirm if the leading indicator is accurate or not. Examples of lagging indicator includes :

- Unemployment rate

- Inflation Rate

- Corporate Profits

Coincident Indicators

Coincident indicators are economic variables that change at the same time as the general economy, hence providing us with real time insights of the current market. Coincident indicators are used to assess the current market situation and for conjunction with leading and lagging indicators to gain deep insights of economic trends and patterns. Example of coincident indicators are :

- Gross Domestic Product

- Industrial Production

- Retail Sales

ALSO READ : What is Volatility in Stock Market ? 2 Important Types and Measures used for Understanding Volatility

FAQs

What are the 6 economic indicators of an economy?

The 6 most widely used economic indicators are Gross Domestic Product, Inflation rate, Interest rates, Consumer Price Index, Unemployment rate, and stock market indices.

What are the indicators of economic success?

An economy is considered to be in good health if there is –

– Low employment

– Moderate Inflation

– Low Interest rate

– Increasing GDP

Final Statement

Economic indicators are of great significance as they inform about the economic health and its direction of a country. All these economic indicators i.e. GDP, unemployment rate, Inflation, Interest rates, help investors to understand the economy to make a more educated decision. While no single indicator can explain the complete economic health, the data from all these indicators offer a deep insight into the economy’s health and trends.

I hope this article about Economic indicators was informative. If you have any suggestions or question, let me know in the comment box.