The Guppy Multiple Moving Average (GMMA) is a technical indicator that traders use to figure out market trends and swings. It’s made up of two sets of moving averages—one short-term, one long-term—that help you see what’s happening in the market right now and where it might be headed. But like any tool, it’s easy to make mistakes if you’re not careful. In this article, we’ll go over some common mistakes traders make with the GMMA and how you can avoid them to trade smarter.

Understanding the GMMA Indicator

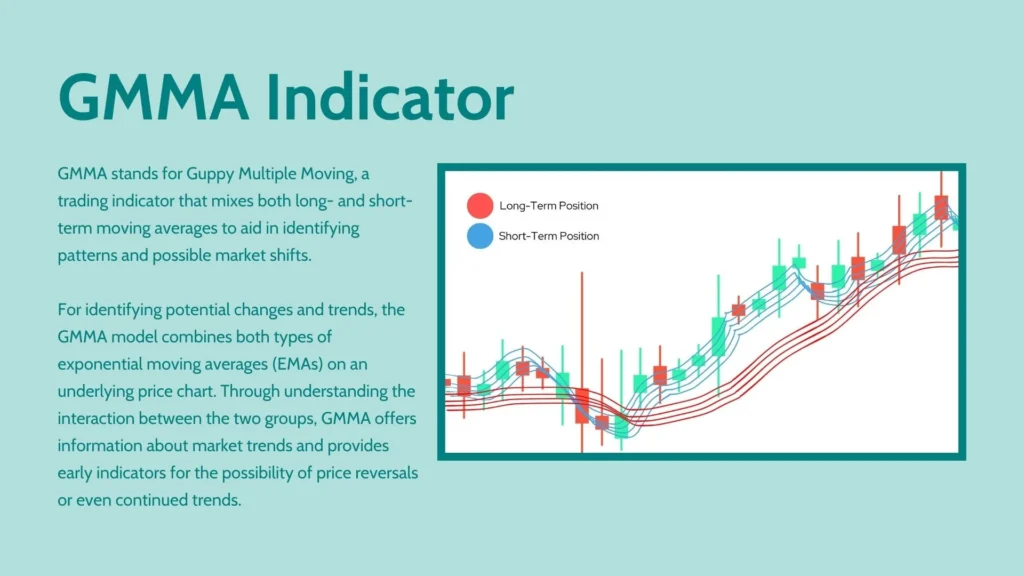

Let’s take a quick overview of what GMMA is and how it works. The Guppy Multiple Moving Average (GMMA) is a trading tool that helps to figure out how the market prices are fluctuating and what the current market trends are. Whether the prices keep falling or rising, it also shows how strong these trends are.

The GMMA uses two moving averages to figure out these things: The short-term average, which gives details about immediate market sentiment, and the long-term average, which informs about where the market is heading.

How do you decide which trend is going and when it changes? The short-term averages crossing over the long-term ones means the trend is changing – the market’s about to turn around; but here’s the catch: not all crossovers are created equal, and if you’re not careful, you might misread these signals.

READ MORE ABOUT Guppy Multiple Moving Average (GMMA)

Common Mistakes to Avoid

By being aware of these pitfalls, you can avoid costly errors and use the GMMA more effectively.

1. Over Dependency

The Guppy Multiple Moving Average (GMMA) is a useful tool that offers more than what others do. But that solely doesn’t mean you should only make your decisions based on one tool. One tool cannot make you a market expert; there are times when it can make mistakes.

What to do here: Use other technical tools like traditional moving averages to confirm the trends GMMA shows. GMMA is just a tool; you are the human who can make even better decisions based on your research, so don’t ignore your judgment based on a tool.

2. Using Too Many Indicators

Using Multiple indicators is a good thing, but if you end up using many indicators, it will end up confusing you. How? If you use and consider too many indicators, you won’t know which one indicator is trustworthy, leading you to make wrong decisions.

What to do here: Use two or three additional indicators to confirm trends and make your decisions. This will help you make more concrete decisions.

3. Neglecting to Set Stop Losses

This one is especially for beginners, they end up relying too much on the GMMA and forget to set stop losses. Using GMMA and relying on it completely are two different approaches. Without stop losses, you are giving space for a big loss.

What to do here: Add stop loss for your trades to make sure you pull out before it’s too late.

READ MORE GMMA vs. Traditional Moving Averages

4. Jumping the Gun on Crossovers

The most commonly made mistake is jumping the gun when you see the short averages crossing the long ones. Many people think that the trend is about to change as soon as the short average crosses the long average waves. Yes, there is a possibility of the trend changing, but that’s not always the case. Sometimes, crossover can reverse quickly, and things can go back to the old ways, making your trade futile.

What to do here: If you see that the GMMA is signalling a trend change, check if other indicators are suggesting the same. You can use additional indicators to check the trend swing concretely, and you can use tools like SMA or EMA.

5. Forgetting the External Factors

GMMA is an amazing indicator that can help you figure out many things within the boundaries of the market. However, GMMA is just a tool on trading platforms; the tool is not connected to external factors like news events, economic reports, or general market sentiment. These external factors can have a big impact on the market, and they can help you figure out upcoming trends even before any tool can.

What to do here: Use GMMA and other technical indicators, but also make sure that you refer to any recent news on your preferred stocks. They can help you make better decisions.

6. Trading Too Much on Small Moves

The short-term average on GMMA can be tempting to use for quick short-term trading, but that temptation can lead to overtrading. If you start making trades on every fluctuation on GMMA, you might end up making too many trades, which can rack up fees and increase your risk of losses.

What to do here: The answer is simple: you don’t make a trade on every fluctuation in GMMA. Instead, look for more substantial trends or use other indicators to confirm what the GMMA is telling you before you act.

7. Failing to Adapt to Different Market Conditions

Markets aren’t static; they can be soaring one day and then moving in a different direction the next. Applying the GMMA in the same way for every market situation could lead to a number of mistakes. For instance, what works well in a market that is trending may not work in a market that is swinging.

What to do here: Keep changing your strategies with changing markets. GMMA may give you accurate signals in a trending market. But for a swinging market, those same signals could be misleading.

READ MORE How to Use the GMMA Indicator for Trend Identification and Confirmation

Final Statement

The GMMA indicator is an effective instrument for traders; however, like any tool, it’s crucial to use it properly. By avoiding these common mistakes – like over-dependence, using too many indicators, understanding crossovers, ignoring the context of the market, overtrading, and not being able to adjust–you can use the GMMA to trade more efficiently and increase your odds of success. Remember that the secret to successful trading isn’t just about making the right choices; it’s also about avoiding the wrong moves.

3 thoughts on “GMMA Guide: Avoid These 7 Mistakes”