“Managing your money is the key to long-term savings and wealth.” Everyone knows this concept, everyone wants to follow it, and most people act as if they follow it, and many who follow end up giving up after some time. And the reason most of them end up failing is because of an improper plan and their failure to stick to the plan, which builds up the frustration of failing to save and stick to the plan, and ultimately, people just end up abandoning the plan.

I’m not someone who can come out of the screen to help you stick to your plan, but what I can do is give you a working framework about how you can create a working personal finance flowchart that fits all your financial components and gives you a working plan. So, let’s start with some basics!

READ MORE 8 Important Steps for Personal Finance for Beginners

Understanding Personal Finance Flowchart

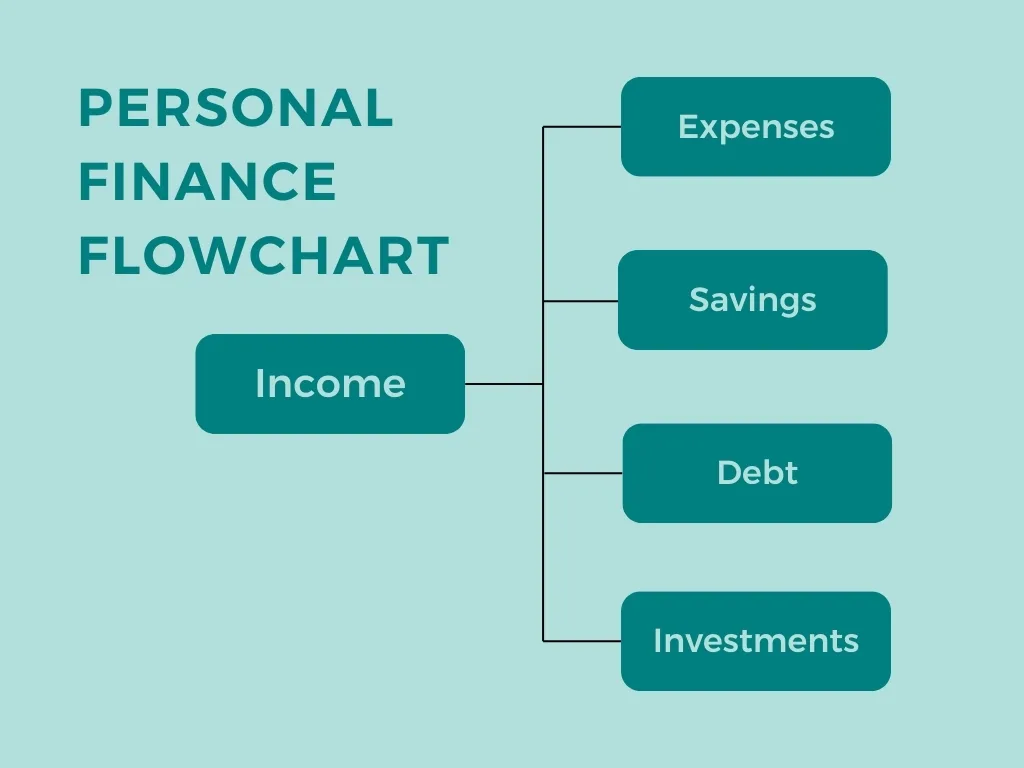

A personal finance flowchart is an easy five-step visual plan that can help simplify budgeting. It provides details on the sources of your earnings, how you make your spending, the debts you have, and the best places to reduce costs and invest. Think of it as a financial dashboard; it shows inflows and outflows, patterns, and helps you identify areas to adjust to meet your financial goals.

It’s like a board of information where these components are listed with their sources. You get a chart about where your money is coming from, where it’s going, and what are the places you can cut back or are spending extra.

For people who are just entering the field of personal finance management or pondering this field, a personal finance flowchart can turn a complicated process into simple steps. It shows your spending habits, sets achievable savings and spending goals, and reduces confusion by giving you a clear picture of your financial situation.

Step-by-Step Guide to Creating a Personal Finance Flowchart

Now that the basics are cleared, let’s build you a personal finance flowchart!

Identify Your Income Sources

In your flowchart, put a box labeled “Income” at the top. List each income source separately and add up the total. This is your starting point.

The flowchart starts with the core of your income source. We have to determine how much income we earn by what sources get us that income. Also, we have to categorize that income if there are side gigs that have a fluctuating income. Normally, people have at least one source of income, whether it’s a job or business, but if there are other sources, it is important to pin them down for the chart.

Your income is the foundation of your financial flowchart. It helps you see what you have to work with and lets you set realistic spending, saving, and debt repayment goals.

Categorizing Your Expenses

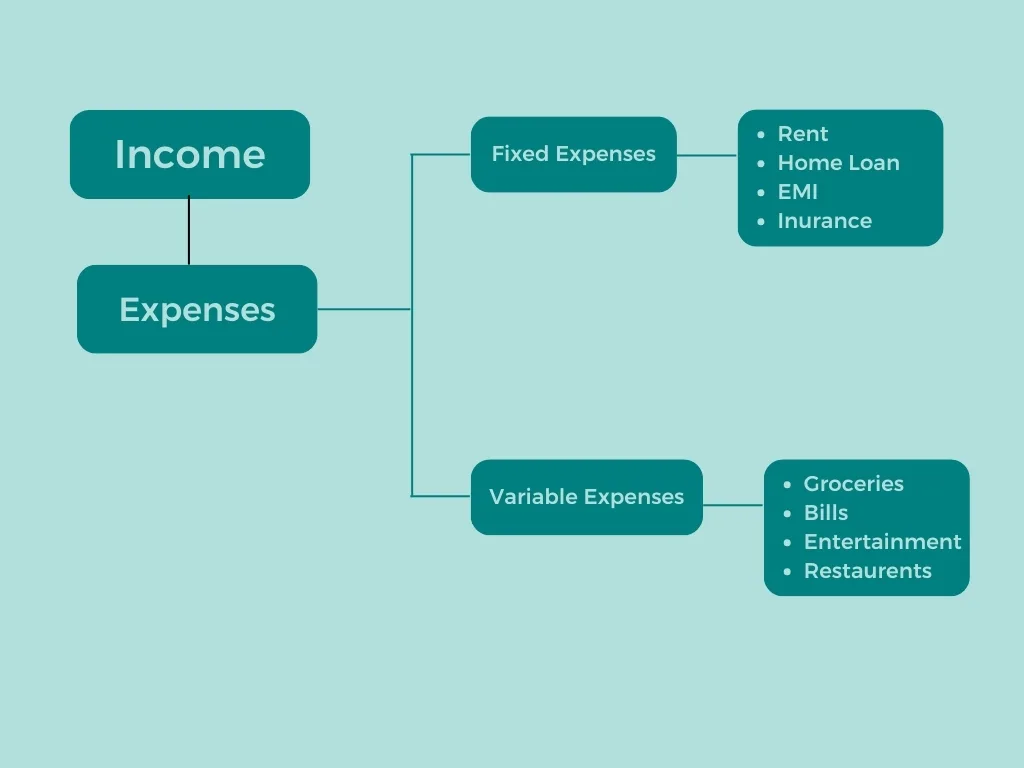

From “Income” branch out to “Fixed Expenditures” and “Variable Expenditures.” List each fixed and variable expense with amounts.

Once we have the income on the board, it’s time to figure out where your money goes. So, there are certain things to consider here: there are expenses that we must spend every month, some expenses remain the same, while some keep changing. So, to make the chart easier to track, let’s split these income into two categories:

Fixed Expenses: These expenses are those unchanging and reoccurring costs that have to be spent every month. This means that this expense remains the same every month. These include things like EMI, tax, insurance premiums, etc.

Variable Expenses: These are the fluctuating expenses that may or may not come up; they are unpredictable, and their cost keeps changing. These include clothing, personal care, restaurant bills, car repair, etc.

Set Up Savings Goals

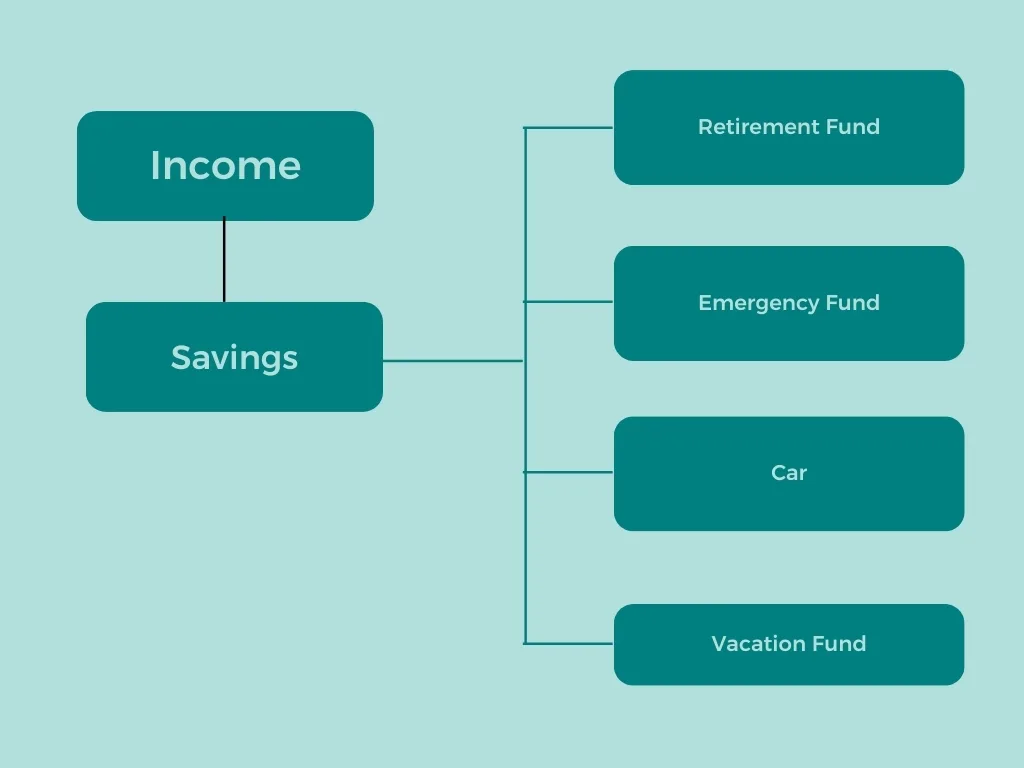

Now, draw a new category from the “Income” box and label it as “Saving.” You can list all your saving goals under this box.

Saving is the core of why you are budgeting your expenses, creating long-term wealth or saving for certain milestones you want to reach. The goal is going to be the core that keeps you motivated.

Let’s take some instances that we can consider in the saving section.

- One of your goals could be to create an emergency fund that helps you stay financially fit in case of job loss or other financial emergencies.

- You can save up for your retirement to live a financially free and peaceful life in your 50s and 60s.

- You might plan to save up for an upcoming vacation, purchase a car, plan a wedding, or do anything you want.

READ MORE 10 Key Components of a Successful Budget Everyone Should Know

Categorize Debt Payments

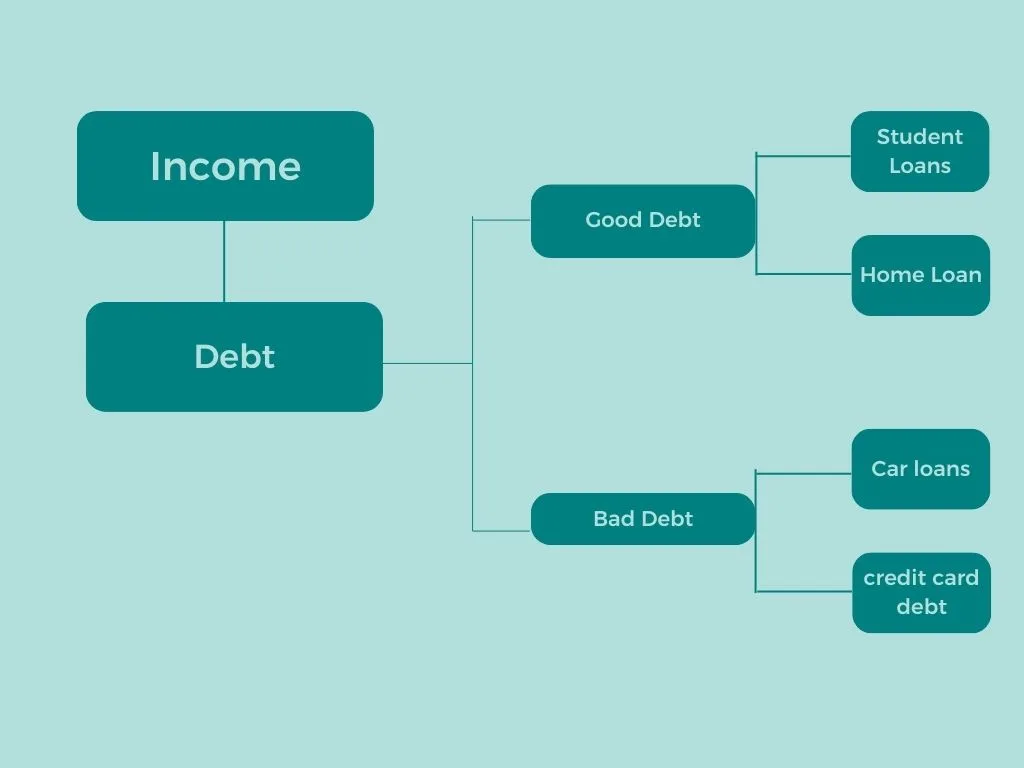

Add one more section under the main branch of the “Income” labeled “Debt Obligations.” List all the debt obligations you have, such as student loans, business loans, home loans, credit card debt, personal loans, or any other debt obligations. This gives an idea of all your debts under one section.

While setting up this section, consider separating the debt on their details. So, there are two main types of categories you can divide these obligations:

Good Debt: These are obligations that will provide you with something valuable in the future. These are productive debts, such as mortgages or student loans.

Bad Debt: These are usually the debts you borrow for something that you quickly consume and depreciate in value. It also drags down your financial situation and can harm your credit. These include high-interest loans like credit card debt.

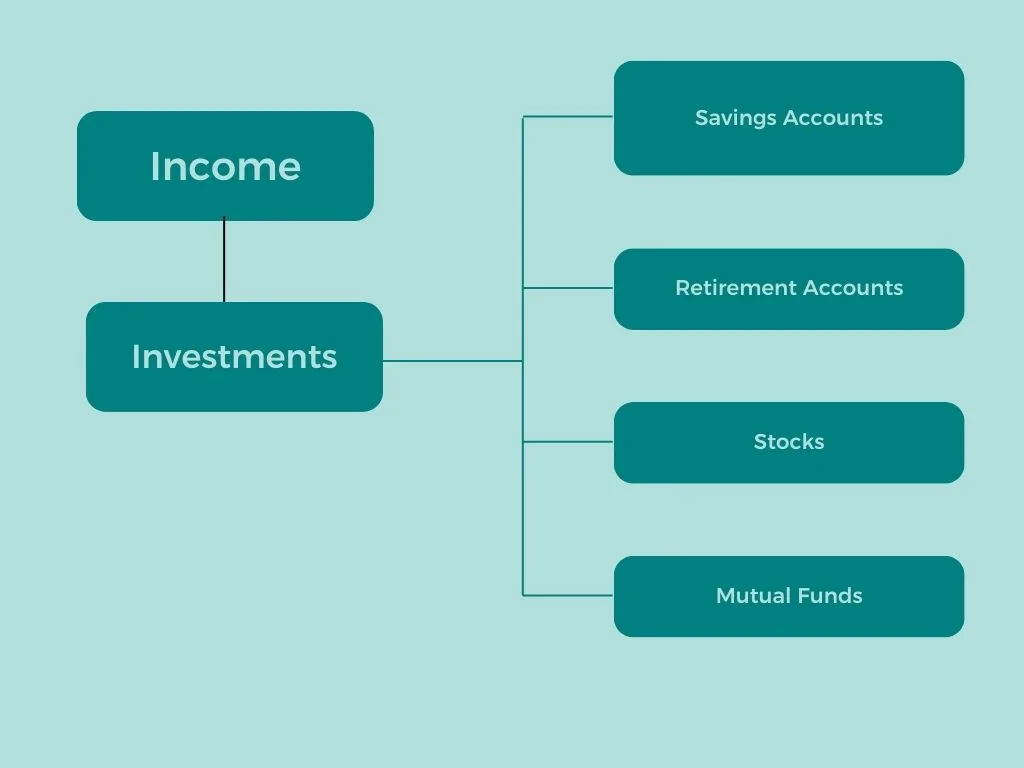

Investments

If you’re planning to invest a certain amount to build wealth over time, include an additional section in the “Income” branch named “Investments.” Include all the accounts you’re planning to invest in, like an account with Angel One for mutual funds, stocks, or even high-interest savings accounts.

As a beginner, you can look into these investment options to start with your long-term wealth:

High-Interest Savings Account: Contact your bank and see if they offer such a savings account. This account generally requires a larger minimum balance, but they offer more returns.

Retirement Accounts: Retirement accounts such as 401(k) or IRA are a great option for you if you are thinking about your retirement plan; they provide moderate returns and tax benefits.

Mutual Funds: Mutual funds are a great way to go for risk-free investment with moderate returns.

Stocks: Stocks are a high-risk, high-reward investment that can provide you with a strong long-term wealth if managed properly.

As a beginner who is just starting out to manage their finances, you should select less risky investment options. Invest a small amount of money every month to move towards your investment goal. Even if you are a risk-lover or have a decent amount you can risk, you can do the same monthly plan for high-risk investments like stocks. The small investment every month helps you ensure you keep working towards your investment goal while managing everything else.

READ MORE 5 Reasons Why Gold Jewelry Might Not Be the Best Investment (But Still Shines!)

Frequently Asked Questions (FAQs)

What is the 30-30-30 rule in personal finance?

The 30-30-30 rules allocate 30% of your income for home expenses such as EMI, another 30% for savings and investments, and the last 30% for necessary things like groceries, bills, etc. The remaining 10% is kept for spending flexibility.

What is the 20-30-50 rule in personal finance?

The 50-30-20 rule states that you allocate 50% of your income for your necessities, 30% is to be reserved for your wants or desires, and the remaining 20% for savings and investments.

What are the 5 basics of personal finance?

Personal finance basics include budgeting, saving, investing, managing debt, and understanding your income.

Final Statement

A personal financial flowchart is an excellent way for those who are just beginning to manage their finances and increase their wealth. The chart will help you know your financial situation and every element of how you spend your money, and it will also help you stay on track with your financial goals.

The flow system used in this chart helps us know where we are spending our money, what our income sources are, what our needs and extra spending are, and where we cut the costs to save.

So, if you are looking to start a budgeting habit to improve your financial situation, a personal finance flowchart is a great place to start. What are you waiting for? Go get started!

1 thought on “5-Step Personal Finance Flowchart for Beginners”