A percentage lease is a common lease agreement used in commercial property, especially in retail stores. In such an agreement, the tenant pays a combination of fixed rent and a percentage of their sales revenue. The percentage is predetermined and only applicable after a certain threshold is crossed, often called the break-even point.

It is a smart lease option for retailers and shop owners; it allows retailers to pay less if the business performs poorly and the opportunity for the owner to earn more if the business performs well. Let’s see how this arrangement works and benefits both parties.

What is a Percentage Lease?

A percentage lease is a mixture of fixed rent, called base rent, and variable rent, called percentage rent. Base rent is the set amount retailers must pay the owner no matter how well their shop performs. Percentage rent is the second portion, which depends on how well the shop performs. The percentage rent only applies after the shop’s sales income exceeds a threshold known as the Break-Even Point – BEP.

A percentage lease is commonly used in retail stores, malls, and restaurants, where the possibility of floor traffic is substantial. The agreement establishes a partnership between the owner and tenant in which the tenant also shares the profit from the business if it performs well.

READ MORE What is a Corporate Lease?

How Does a Percentage Lease Work?

A percentage lease is a mixture of fixed rent, called base rent, and variable rent, called percentage rent. Base rent is the set amount retailers must pay the owner no matter how well their shop performs. Percentage rent is the second portion, which depends on how well the shop performs. The percentage rent only applies after the shop’s sales income exceeds a threshold known as the Break-Even Point – BEP.

A percentage lease is commonly used in retail stores, malls, and restaurants, where the possibility of floor traffic is substantial. The agreement establishes a partnership between the owner and tenant in which the tenant also shares the profit from the business if it performs well.

How Does a Percentage Lease Work?

A percentage lease works by implementing a combo of two things: a fixed rent and a variable rent. The tenant pays the fixed rent to secure the store from the owner, and the variable rent is paid when the sales revenue crosses a predetermined BEP.

Let’s take an example,

- Fixed Rent: $10,000 per month

- Break-Even point: $75,000 in monthly sales

- Percentage Rent: 5% of sales above $75,000

If the tenant generates $100,000 in sales during a month, they will pay:

- Fixed Rent: $5,000

- Percentage Rent: 5% × ($100,000 – $75,000) = 5% × $25,000 = $1,250

So, the total rent for that month will be:

$10,000 + $1,250 = $11,250

On the other hand, if the store generates less than $75,000, say $60,000, then the variable rent will be eliminated, and the tenant will only pay the fixed rent of $10,000.

Components of a Percentage Lease

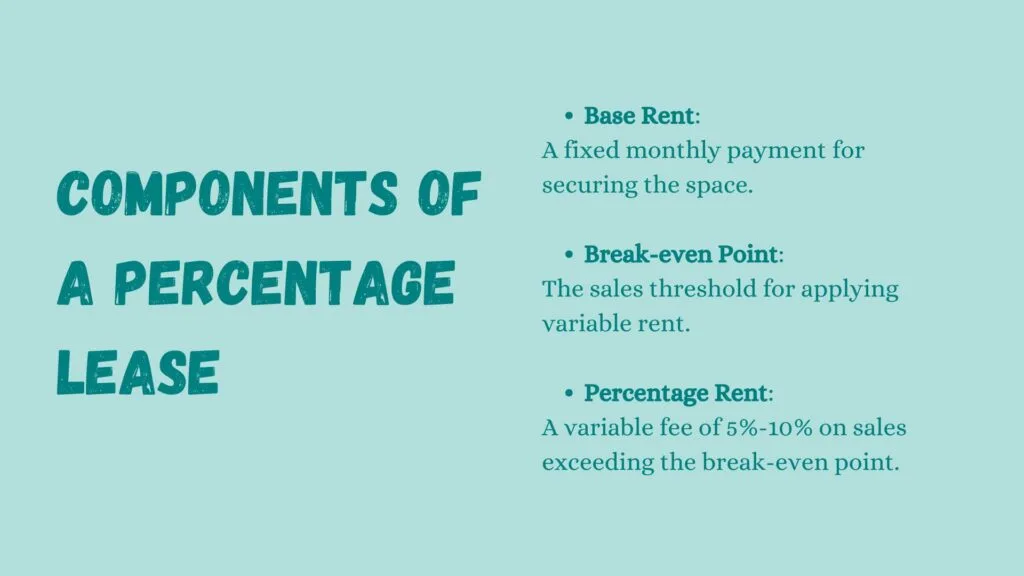

- Base Rent: The base rent is the fixed rent the tenant must pay to secure a place. The base rent will be the fixed aspect of the agreement, which provides the owner with a fixed source of income.

- Break-even Point: BEP is the threshold; once the sales revenue crosses this point, the variable rent, called the percentage rent, starts to apply. The BEP ensures that the variable rent only applies when the business is doing well, providing the tenant more flexibility.

- Percentage Rent: The second part of the rent, the variable rent, is only applicable when the business generates revenue beyond a predetermined break-even point, which suggests the business is doing well. The variable rent usually charged for this type of arrangement ranges between 5%-10% of the total sales revenue.

READ MORE Top 12 Benefits of Renting Instead of Buying

Advantages of a Percentage Lease

For Tenants

- Lower Fixed Cost: Tenants are required to pay a fixed rental cost for the place, which is usually much lower when compared to a traditional lease, where the tenant has to pay the complete amount without variable rent. The percentage rental component provides tenants with the flexibility of lower rental costs during their low seasons.

- Shared Risk with Landlord: The combination of fixed and percentage rent means that the owner also contributes something to the business and shares the risk of losing money during low season. If the shop does not generate any revenue beyond the break-even point, the tenant does not have to pay the rent in a percentage.

- Incentivized Landlord Support: Even though the landlord is the non-documented partner of the business, they still receive a share of the profit as rent when the business makes profits. They provide lower rental costs, help maintain the property, and even organize events to attract more traffic to the business.

For Landlords

- Profit Potential: Even if the landlord reduces the rent costs to provide more flexibility to the tenants, they can make more than what traditional rental income would generate. During peak seasons, the percentage rental could go more than double, giving a solid income foundation for the landlord.

- Long-term Partnerships: The reduced cost and profit-based percentage rent create a much better tenant environment. Such an environment can encourage long-term partnership for both parties where they mutually benefit from the agreement.

- Guaranteed Minimum Income: Landlords are guaranteed to receive a fixed rental income every month. Even if the rent is not as high as other traditional rental agreements, the risk also provides the landlord with the opportunity to earn more than that.

Challenges of a Percentage Lease

- Income Fluctuations for Landlords: Under the agreement on percentage lease, the landlord can only charge the percentage rent once the company’s sales exceed the break-even threshold. This means that if the business fails to generate enough revenue, the landlord will only receive the fixed rent, which is less than the traditional rent.

- Complexity in Reporting and Tracking Sales: For this type of agreement to work smoothly, the tenants must generate a proper sales report and track all sales aspects accurately. Once the report is generated, they pass it on to the landlord; it can be time- and energy-consuming to generate a different sales report per the landlord’s request.

- Unpredictable Rent Costs for Tenants: Although the landlord is willing to adjust to lower fixed rent, The fixed rent can fluctuate during peak seasons. The fixed rent will likely increase if the location becomes more popular or draws more traffic.

- Conflicts: False sales reports are one of the most significant risks for the landlord. Tenants could use false data to generate false revenue reports, claiming that sales did not meet the agreed break-even point. The landlord can avoid this by conducting regular audits of the reports to ensure accuracy. However, this regular interference can also result in potential conflict.

Tips for Negotiating a Percentage Lease

Set a Realistic Break-even Point

A realistic break-even point will make sure that the landlord receives their percentage of rent whenever the revenue crosses it. The BEP should based on your projected sales revenue. While setting the BEP, don’t set it too high so that it never triggers the percentage rent; the landlord will lose interest in supporting your business.

Negotiate a Fair Percentage Rate

Agree on a fair percentage of rent based on your business potential. A business that has products or services with lower profit margins and a lower percentage of rent is more suitable. On the other hand, businesses with products or services with higher profit margins can easily manage higher percentage rent.

Consider Adding Caps

As the tenant, you should negotiate to add a percentage rent cap on the agreement to ensure you aren’t paying too much. This ensures that your business generates proper profits during high sale seasons and that the landlord also gets a fair share.

Clarify Reporting Requirements

To avoid the main conflict, suspects must agree on how and when sales will be reported. Make sure that the agreement has points that help to ensure transparency. You can also add a fee clause if a false report is generated to make it more rigid.

READ MORE Tax Lease: Definition, How it Works, And Benefits

Frequently Asked Questions (FAQs)

What is an example of a percentage lease?

Let’s say a tenant leases a shop using a percentage lease with a monthly base rent of $10,000. If their monthly sales cross monthly sales revenue over $60,000, then the tenant will 5% of their sales revenue.

Who benefits most from a percentage lease?

Both parties enjoy the benefits of this arrangement; the tenant enjoys lower fixed rent and shared risk, while the owner can earn more profit.

How do you calculate the percentage leased?

The formula for the percentage leased is:

Percentage Leased = (Leased Area / Total Area) × 100

What is a percentage lease most often associated with?

Percentage leases are most commonly used for retail stores, malls, and restaurants where rent is linked to the tenant’s sales performance.

Final Statement

A percentage lease is a smart way of renting for businesses that are more prone to seasonal traffic and sales. A percentage leasing arrangement is more than a simple contract; it fosters collaboration where both parties share the rewards and risks of business success.

Tenants get more flexibility to keep their business cost-effective with lower fixed rents; it also helps to keep the business’s expenses low during the off-season. Such flexibility can be a huge pro for small businesses and startups. On the other hand, the landlords are motivated to benefit from their tenants’ financial well-being. So they provide all the support they can, including organizing marketing campaigns, improving property amenities, or hosting events to drive foot traffic.

Percentage lease can be a great way for new businesses to enter or even establish businesses to expand their horizons into a new market, where both the tenant and the landlord can mutually benefit from this agreement and achieve long-term success.